1 Introduction / Executive Summary

In this Leadership Compass, we evaluate solutions that can serve as a foundation for customers who need to utilize verified identity in processes, be it in onboarding an unknown customer or verifying that a contractor is who they claim to be. Providers of Verified Identity are vendors that can issue a digital verified identity or enable an external verified identity to be onboarded and used by the enterprise. Full-service providers can also register, onboard, and authenticate using the verified identity.

The term "Verified Identity" stands for digital identities that have been verified to describe a real-world identity in digital form, and that the verification remains valid throughout the identity lifecycle. Therefore, Providers of Verified Identity are the vendors that can issue such a verified identity or enable an external verified identity to be onboarded by an enterprise.

Identity verification has previously been viewed as a product category of its own but is increasingly being integrated into full-service solutions, enabling identity verification to be conducted remotely, automatically, passively, federated from verified accounts, in a decentralized manner and/or in parallel to other steps of the identity lifecycle.

This is an emerging market space, and the vendors that are assessed in this Leadership Compass display different methods to provide an enterprise with a verified identity. Some rely on federating verified account information, such as from banks. Others leverage the growing eID ecosystem particularly in Europe. Some embrace the emerging Verifiable Credentials model. And others use the document/biometric/liveness verification model which is gaining popularity and accuracy. Each approach must be assessed individually based on enterprise requirements.

This Leadership Compass gives an overview of the market, required capabilities of a well-rounded solution, and detailed information on the participating vendors.

1.1 Key Findings

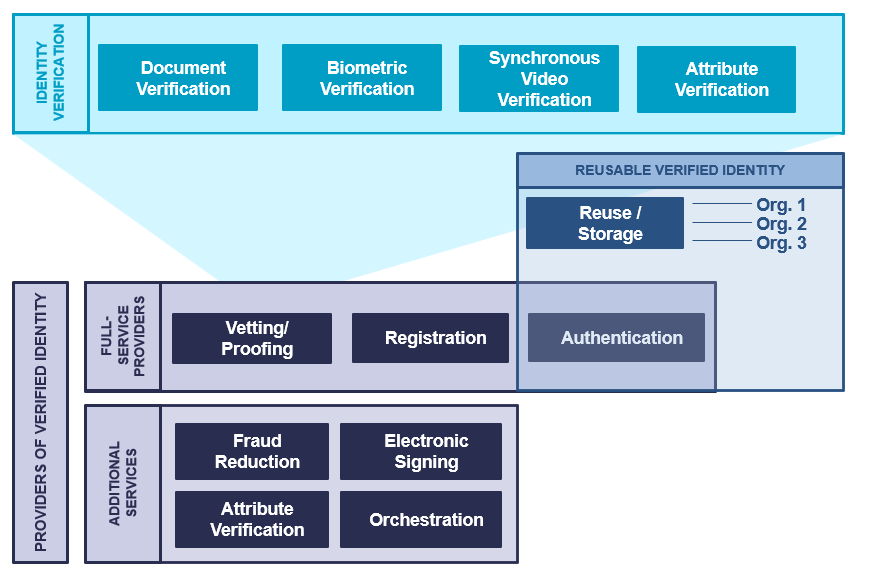

- This report compares full-service verified identity providers, or vendors that conduct digital identity verification alongside providing several of the identity lifecycle stages including vetting/proofing, registration, authentication, and additional services such as fraud reduction, electronic signing, attribute verification, and orchestration.

- A strong ecosystem rating and robust partnerships with both technology providers and institutes like national registries contribute to a strong solution.

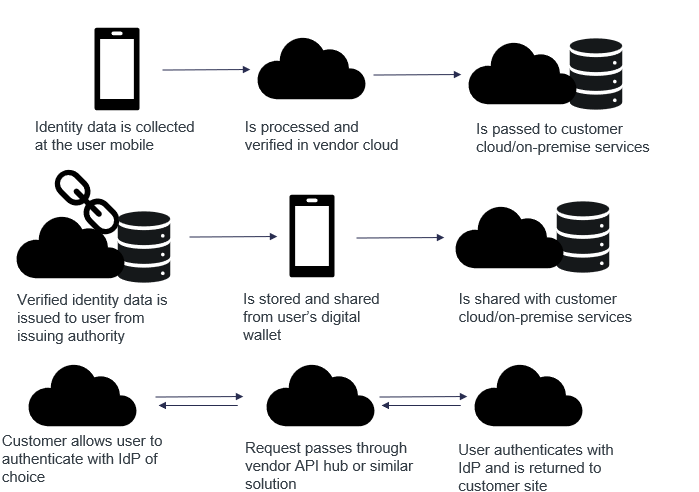

- There are roughly three models of how data flows when a verified identity is provided to a customer or relying party: identity verification is processed in the cloud, processed or stored on the mobile device, or federated directly from the identity provider.

- There are roughly four technology methods that are combined to provide a verified identity: remote automated, eID integration, federating verified accounts, and use of Verifiable Credentials.

- Orchestration features in a solution help to gain adequate global coverage of identity documents, connections to national registries, and coverage for local regulation.

- Overall Leaders in alphabetical order are: 1Kosmos, Experian, HID Global, IDEMIA, Microsoft, Ping Identity, Thales.

- Product Leaders in alphabetical order are: 1Kosmos, HID Global, IDEMIA, Experian, Ping Identity, Thales.

- Innovation Leaders in alphabetical order are: 1Kosmos, HID Global, iProov, Microsoft, Ping Identity, Thales.

1.2 Market Segment

This Leadership Compass analyzes digital identity solutions that perform identity proofing and verification or enables a verified digital identity to be imported and easily reverified. This report compares full-service verified identity providers, or vendors that conduct digital identity verification alongside providing several of the identity lifecycle stages. This could include:

- Vetting/Proofing

- Registration

- Authentication

- Additional services: fraud reduction, electronic signing, attribute verification, orchestration

The graphic above visualizes the interplay between the three major identity verification market segments: Providers of Verified Identity, Reusable Verified Identity, and Identity Verification.

- Providers of Verified Identity: Full-service providers of identity verification, registration, and authentication, with additional services such as fraud reduction, attribute verification, digital signing, and orchestration.

- Reusable Verified Identity: a verified identity that can be presented to multiple organizations that are separate from the identity provider (IdP) and/or in different roles (personal, citizen, professional).

- Identity Verification: the vendors that provide best-of-breed verification solutions, often specializing in one or more of document verification, biometric verification, video verification, or attribute verification. Identity Verification vendors often provide components to Providers of Verified Identity, or have technology partnerships with them.

1.3 Delivery Models

Providers are trending towards a cloud-based delivery model, with support of multi-tenancy and containerization. The collection and processing of personal data for identity verification – even when it is held only for the duration of the verification - must be completed in a secure and privacy-compliant manner, which raises necessary questions of where identity document data or biometric data is (temporarily) held and where data centers are located. Many vendors do offer options to deploy the solution on-premises for regulated industries.

There is a high dependence on consumer apps for verification steps - either provided by the vendor or with SDKs provided by the vendor to integrate into customer apps and services. For those vendors that provide federation to verified account information or identity attributes, an API-forward architecture is common.

A particularity of the Full-Service Providers of Verified Identity market is the reliance on technology partnerships. Since a wide range of services related or dependent on the verified identity are being offered, it is rare that a vendor can supply everything in-house and still provide excellent global coverage. Therefore, technology partnerships and ecosystem are very important to leverage best-of-breed document scanning, biometric matching, attribute verification, or federation for the target regions. In-house technology may be sufficient for one or more regions, but may not give adequate coverage of the entire world. Partnerships with national registries, law enforcement, issuing agencies, etc. are also valuable, giving access to authoritative sources to validate identity data and insight into security features of documents to better verify them. Well-integrated partnerships are one of many different signals of a strong solution.

There are differing approaches on processing and storing verified identity data. Some vendors prefer to transmit collected identity information to their cloud – encrypted at rest and in motion – for processing. After the verification result is reached, the data is deleted from the vendor cloud, and passed to the customer to hold based on the industry-required retention period. Some of these cloud vendors also support authentication using a verified attribute, such as facial biometrics that have been bound to an identity document. This requires a template to be stored so that future authentication attempts (a selfie) can be matched against the authoritative source (the biometric template collected during onboarding). This must be stored according to the customer's risk appetite and applicable regulatory and privacy guidelines, directives, or laws, which could be with the vendor or with the customer. Vendors that take this method typically do not trust the user device and the security features of the cloud. This method often is device-independent, meaning that the user is able to verify their identity or authenticate regardless of the device that they used to initially enroll.

Other vendors prefer to keep identity information local on the user's device. These typically feature wallet apps, making use of a secure enclave on the device itself to store identity information and biometric templates. While wallet apps are often associated with decentralized identity solutions, this is not always the case, and can be based on other standards such as ISO 18013-5 for a mobile driving license (mDL/mDoc). Solutions like this will rely on the user's mobile device to varying degrees: it will use the built-in camera, and may use the built-in NFC reader or biometric functionality (i.e. Touch ID and Face ID with iOS devices). Some vendors also perform ownership and reputation checks via commercial service providers, or SIM/eSIM-based authentication directly with the mobile network operator (when available). Some vendors bind key device information such as a phone number or FIDO keys to the reference record for identity or credential management. Other vendors will choose to use proprietary biometric functionality and bypass the built-in features of the mobile device. Vendors that choose this method typically prefer a user-centric model where users hold and control their identity information, and choose who to share it with. No collection of identity data is created in the vendor or customer cloud using this method, but users may be limited to a single device (often their mobile phone) which holds their digital wallet for identity verification, authentication, signing, etc.

Other vendors choose a different model altogether - federation of a verified account. These vendors typically build partnerships with identity providers (IdPs) with verified account information, especially banks. When verified identity data is required by a relying party, the user is routed by the vendor to their bank, where they securely authenticate. They approve the release of verified identity attributes to the relying party. Neither the vendor nor the user stores this identity information, which remains with the IdP. This comes with strong usability and security features as long as the IdP has adequate protections in place.

1.4 Required Capabilities

Providers of Verified Identity must provide a majority of the following capabilities:

- Document Verification: Verification of government-issued and/or real-world documents. Ability to process multiple types of identity documents, from different regions, in different forms (updates, versions) and be checked for authenticity against authoritative sources such as a national registry database. Triangulate data from OCR, smartphone or hardware NFC of embedded chip, and the MRZ of identity documents to increase the confidence level that the document is valid and authentic.

- Biometric Verification: Collect and process an authoritative sample for face, voice, fingerprint, and/or behavioral biometrics for initial verification and for optional later use in authentication. Secure storage, appropriate use of 1:1 and 1:n matching for adequate privacy protection and identification purposes.

- Attribute Verification: Collect, verify, and share standard identity attributes (name, DOB, address, contact info, identification numbers, account numbers) and nontypical identity attributes (education credentials, employment credentials, health records, etc.).

- Registration: Registration of a new identity, or registration of an existing external identity. Registration refers to storage of identity attributes in the organization's directory service and filtering of identity attributes from the IdP. In the case of the latter, the solution supports BYOID for registration and later authentication via federation with reliable IdPs like BankID in the Nordics, and that is interoperable with eID schemes like eIDAS. Capabilities such as Directory User Mapping and User-Driven Federation can play a role here.

- Workforce Applicability: The solution's applicability to workforce IAM use cases, serving employees, partners, suppliers, contractors, freelancers, etc.

- CIAM Applicability: The solution's applicability to consumer IAM use cases, serving individuals and customers to access a service provider's resources and services. Should have self-service functions and the ability to synchronize accounts between devices.

- Authentication: Apply the verified identity to authentication and/or as a second factor, step-up, dynamic, etc. Authentication methods could include federation, biometric, PIN, device signals QR/Push Notifications, OTP, and others. Interoperability with authentication sources (including eID schemes, federated partners, FIDO, Windows Hello, etc.) and support of standards (OIDC, SAML) is critical.

- Fraud Reduction: Ensure that the identity documents, biometrics, attributes, or context is valid, held by the individual it describes, and not falsified through a variety of methods: IP address collection, GPS, data aggregation, sanctions lists, behavioral features, keystroke analysis, and more. Confidence scoring should provide a recommendation on the identity's reliability, and may be supported with AI/ML.

The inclusion criteria for this Leadership Compass are:

- To provide a majority of the above-listed capabilities

- An emphasis on providing a digital verified identity for onboarding and later use

- A baseline level of support for the capabilities listed above, including use of partner technology (e.g. own technology for biometric onboarding, partner technology for document scan and validation)

- Support for cloud, hybrid, or on-premises deployments

The exclusion criteria for this report are:

- Point solutions that only provide identity verification, or elements of identity verification (e.g. only behavioral biometrics without the capacity to generate a digital identity attribute) will not be considered

- Vendors without active deployments with customers will not be considered

However, there are no further exclusion criteria such as revenue or number of customers. We cover vendors from all regions, from start-ups to large companies.

2 Leadership

Selecting a vendor of a product or service must not only be based on the information provided in a KuppingerCole Compass. The Compass provides a comparison based on standardized criteria and can help identifying vendors that shall be further evaluated. However, a thorough selection includes a subsequent detailed analysis and a Proof of Concept of pilot phase, based on the specific criteria of the customer.

Based on our rating, we created the various ratings. The Overall rating provides a combined view of the ratings for

- Product

- Innovation

- Market

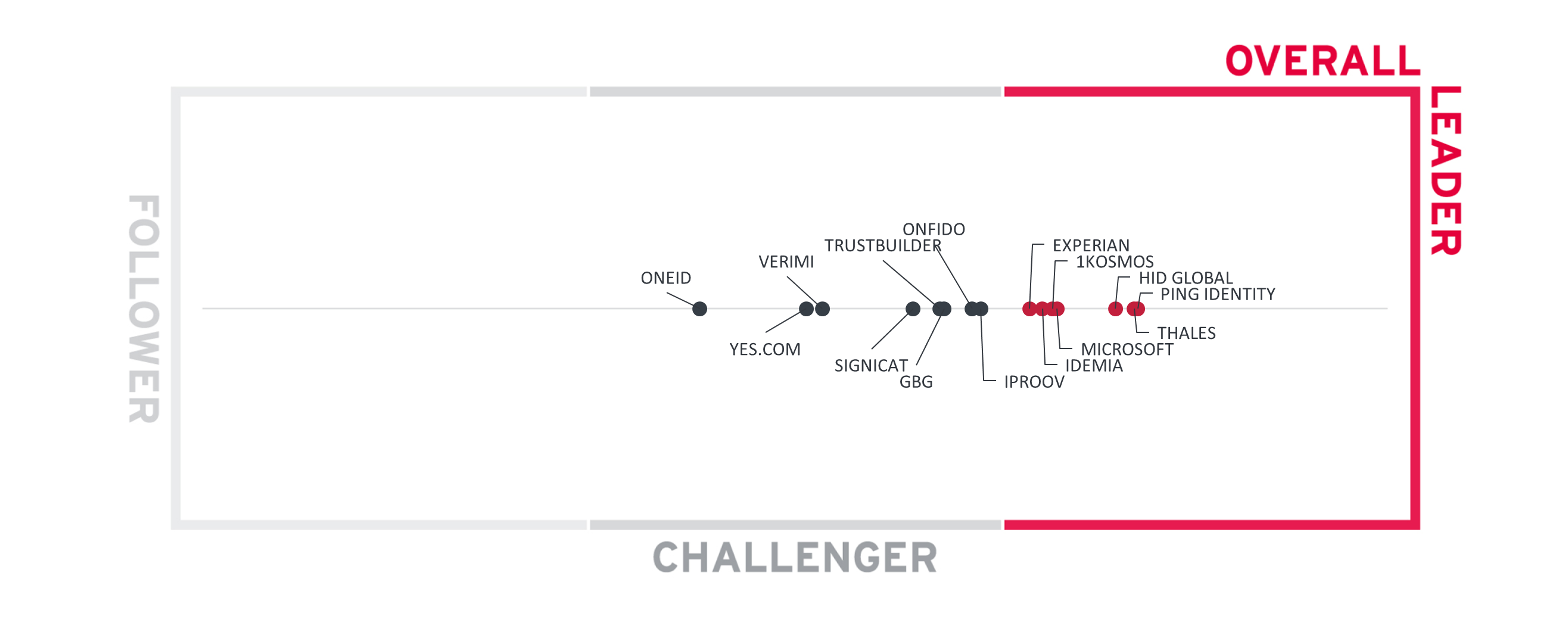

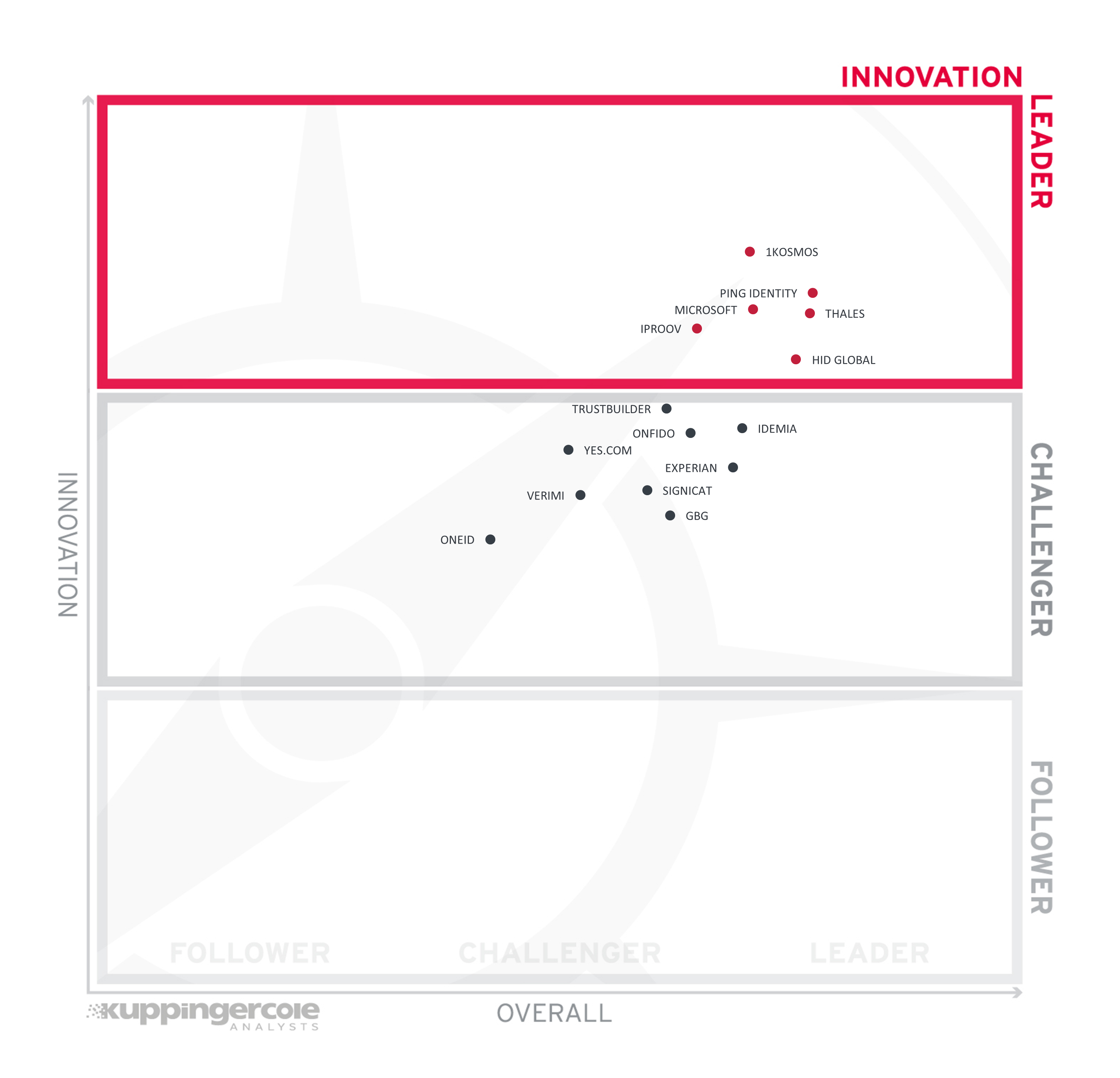

2.1 Overall Leadership

The Overall Leadership rating is a combined view of the three leadership categories, i.e., Product Leadership, Innovation Leadership, and Market Leadership. This consolidated view provides an overall impression of our rating of the vendor's offerings in the particular market segment. Notably, some vendors will perform better in different aspects. For example, some vendors have a strong market presence but display lower ratings in innovation, while other vendors may show their strength in Product Leadership and Innovation Leadership but have a relatively low market share or lack a global presence. Therefore, we strongly recommend looking at all leadership categories, the individual analysis of the vendors, and their products to gain a comprehensive understanding of the players in the market segment.

In the Overall Leadership rating chart, we see densely packed groups of competitors. There are seven vendors in the Leader section displayed in red. These include known players in the identity issuance space such as Thales, HID Global, and IDEMIA, credit scoring and identity verification actor Experian, and enterprise identity vendors Ping Identity, Microsoft, and 1Kosmos.

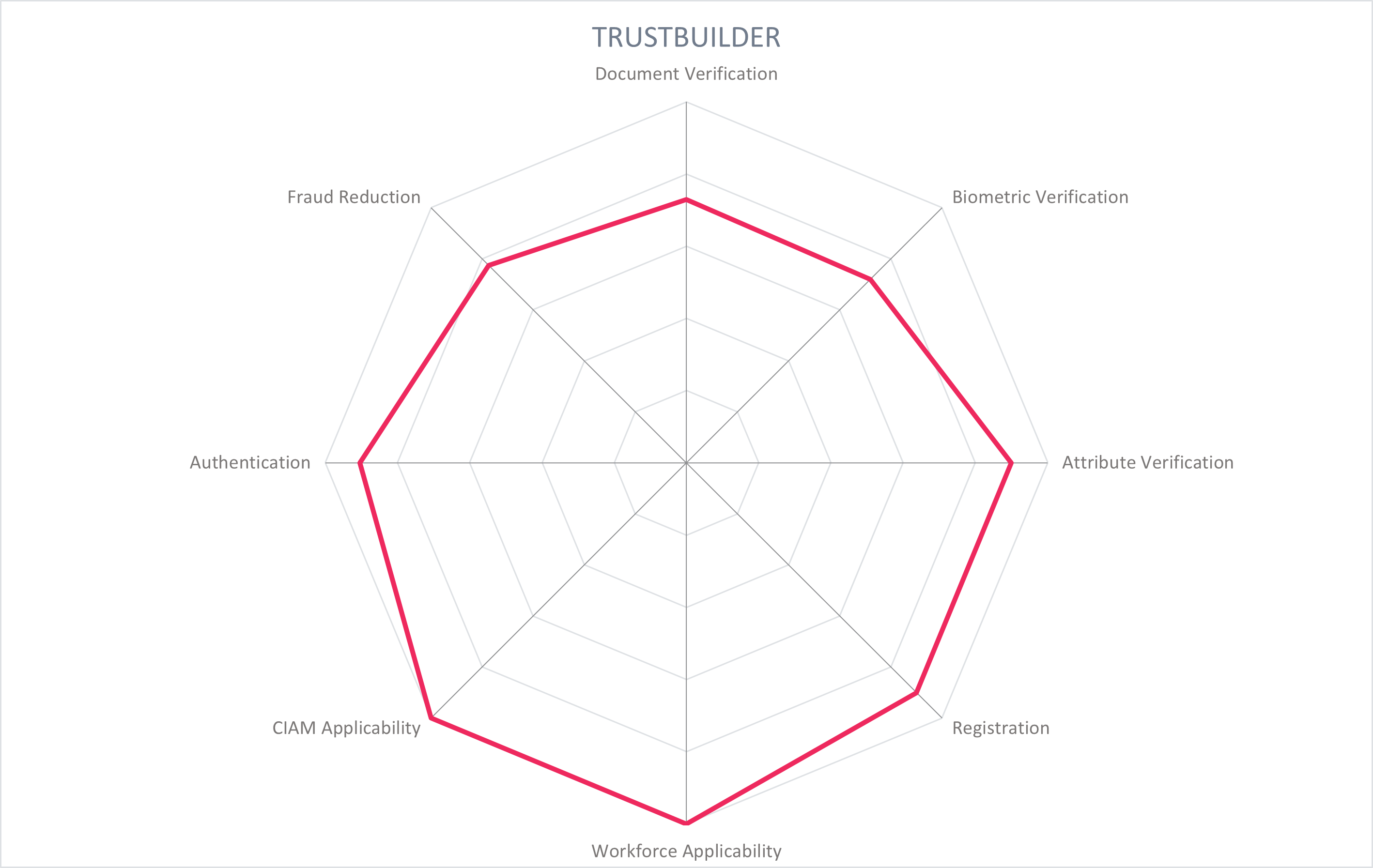

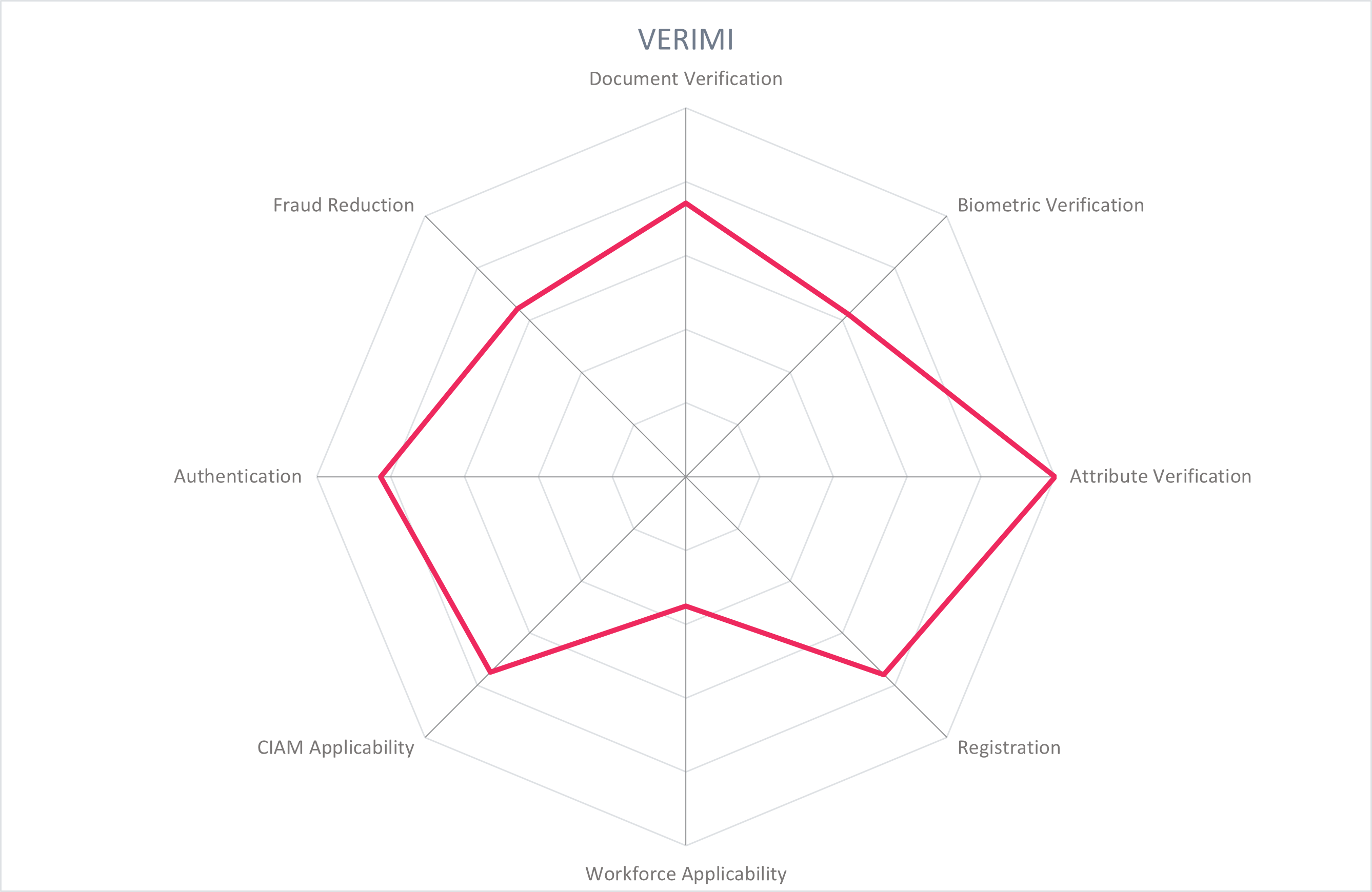

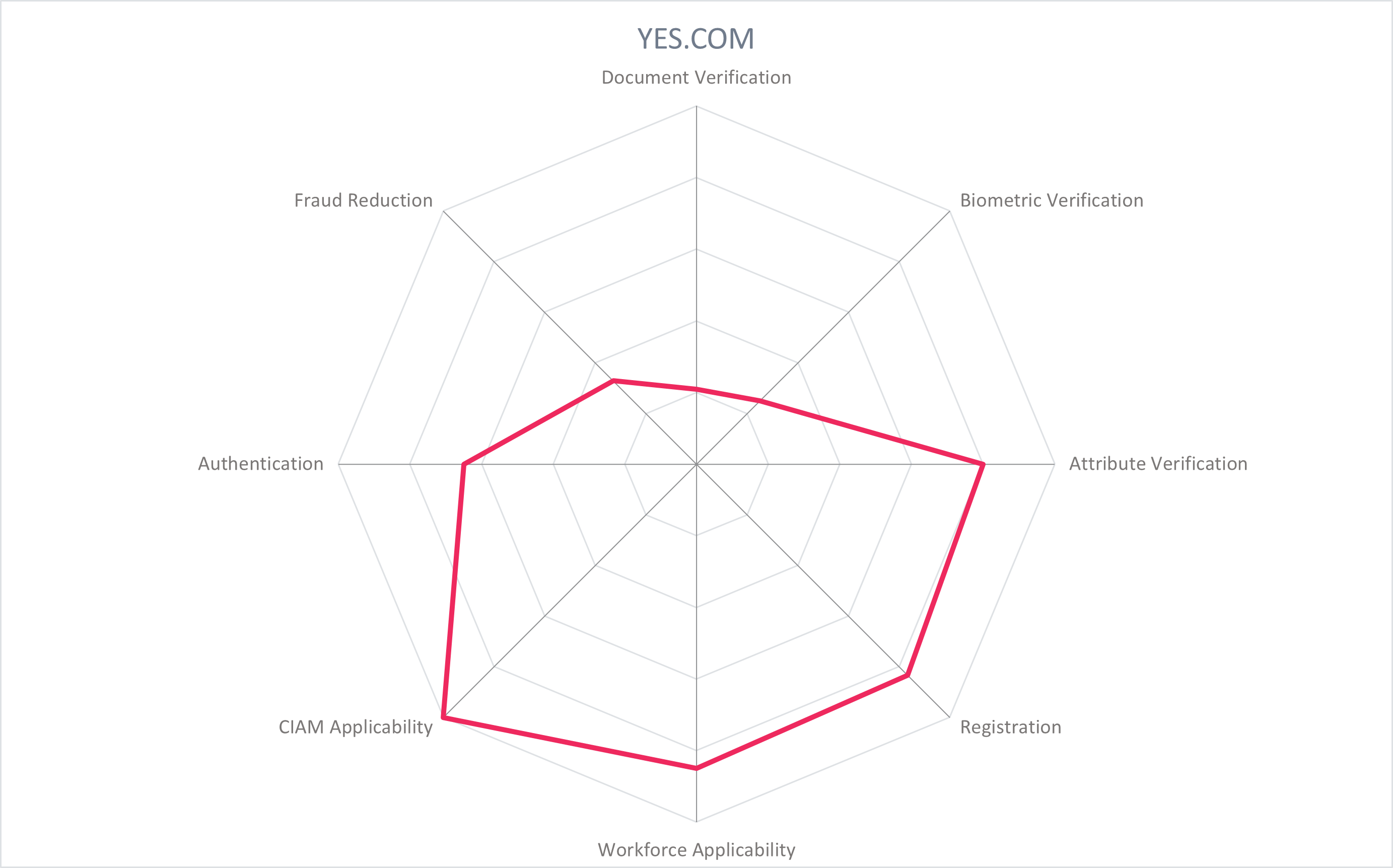

Nine vendors are placed in the challengers section. The cluster containing iProov, GBG, TrustBuilder, Onfido, and Signicat represent well-rounded products with relatively strong global presence and market size. Verimi, Yes.com, and OneID deliver quality products with more focused regional reach and capabilities.

Leadership does not automatically mean that these vendors are the best fit for a specific customer requirement. A thorough evaluation of these requirements and a mapping to the product features by the company's products will be necessary.

Overall Leaders are (in alphabetical order):

- 1Kosmos

- Experian

- HID Global

- IDEMIA

- Microsoft

- Ping Identity

- Thales

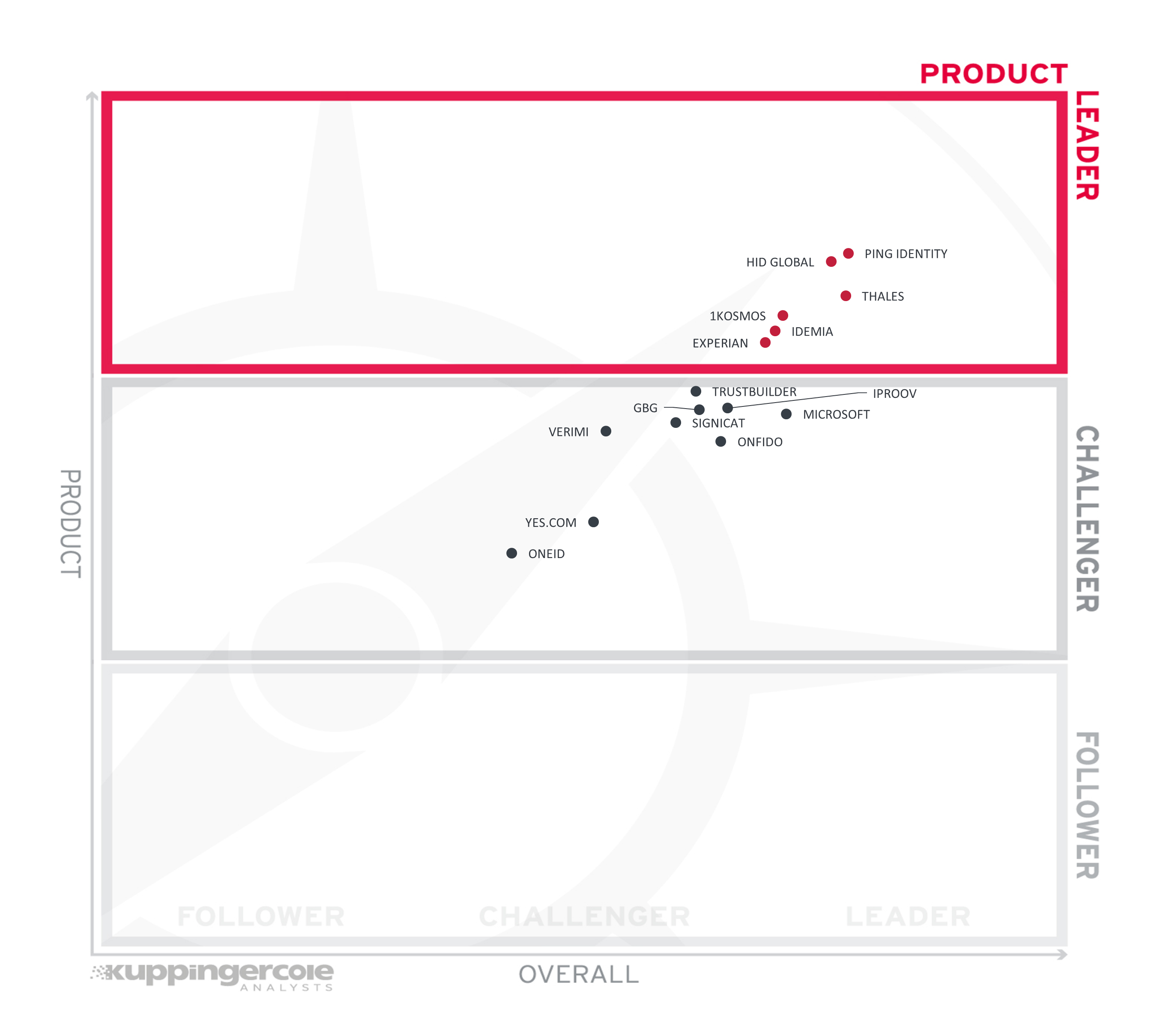

2.2 Product Leadership

Product Leadership is the first specific category examined below. This view is mainly based on the analysis of service features and the overall capabilities of the various services.

Product Leadership is the view in which we focus on the functional strength and completeness of the solution.

Ping and HID Global lead the way with a strong IAM foundation for the full-service identity verification capabilities, including onboarding and authentication. Thales, 1Kosmos, and IDEMIA are also in the leaders segment with strategic focus on identity verification and for its reuse during later stages of the identity lifecycle. Experian's extensive network for attribute verification and fraud prevention add to its identity verification capabilities.

Challengers include TrustBuilder and Signicat, both leveraging European eIDs focusing on different regions to provide verified identities for enterprise onboarding and authentication. iProov is a best-of-breed biometric verification vendor. GBG has an impressive range of identity verification products and capabilities and is working towards fully integrating them for a unified experience. Microsoft is making remarkable advancements in enabling organizations to issue Verifiable Credentials backed by identity verification and exchange these across ecosystems. Onfido is a known name in providing remote identity verification, and is expanding to serve more aspects along the identity lifecycle. Verimi serves the German market as a full-service provider of verified identity. Yes.com leverages the open banking ecosystem in Germany for user-friendly access to verified identity, as does OneID in the UK.

Product Leaders (in alphabetical order):

- 1Kosmos

- HID Global

- IDEMIA

- Experian

- Ping Identity

- Thales

2.3 Innovation Leadership

Next, we examine innovation in the marketplace. Innovation is, from our perspective, a key capability in all IT market segments. Customers require innovation to meet evolving and even emerging business requirements. Innovation is not about delivering a constant flow of new releases. Rather, innovative companies take a customer-oriented upgrade approach, delivering customer-requested and other cutting-edge features, while maintaining compatibility with previous versions.

There is plenty of opportunity for innovation in this market segment. Binding a real-world identity to a digital credential in the most secure, user-friendly, and privacy-preserving method requires creativity and a willingness to change the status quo. Many different methods are represented in this Leadership Compass, which must be evaluated on a case-by-case basis.

Leading the innovation group is 1Kosmos, a pioneer in using decentralized identity credentials that carry a high level of assurance for both workforce IAM and CIAM use cases. Ping Identity also takes a decentralized approach while also building out an impressive ecosystem of identity verification partners to meet global regulatory and customer needs. Microsoft strives to enable decentralized identity credentials backed by verified real-world attributes to interoperate with existing infrastructure such as Azure AD with as little friction as possible. Thales and HID Global make strides to enable citizen IDs that interoperate with emerging Mobile Document (mDoc) standards as well as emerging decentralized wallet standards. iProov focuses on biometric matching and Genuine Presence Assurance for a user-friendly but secure approach to verifying the identity and presence of an individual.

Challengers in the innovation section still have valuable contributions. TrustBuilder works with an attribute-based access control model based on verified identity attributes and leverages the growing European eID ecosystem. Yes.com is advancing initiatives like Global Assured Identity Network (GAIN) for an interoperable and secure means of exchanging verified identity information. Onfido has made strides in establishing the smooth user experience of remote identity verification. IDEMIA, Experian, and GBG expand their traditional portfolios to include identity verification. Signicat brings valuable insight into the digital signatures space. Verimi and OneID leverage existing ecosystems to advance new use cases for verified identity.

Innovation Leaders (in alphabetical order):

- 1Kosmos

- HID Global

- iProov

- Microsoft

- Ping Identity

- Thales

2.4 Market Leadership

Lastly, we analyze Market Leadership. This is an amalgamation of the number of customers, number of transactions evaluated, ratio between customers and managed identities/devices, the geographic distribution of customers, the size of deployments and services, the size and geographic distribution of the partner ecosystem, and financial health of the participating companies. Market Leadership, from our point of view, requires global reach.

Thales, HID Global and Experian lead the segment. IDEMIA and Ping Identity follow, with GBG, Microsoft, and Onfido rounding off the Market Leaders. These vendors all have a global presence and reputation, with product capabilities spanning the globe.

Signicat leads the challengers with a strong market presence in the Nordics. iProov and 1Kosmos are both growing their global market share and expanding the regions in which they serve customers. TrustBuilder has a strong European presence. Verimi and Yes.com are both focused on the German/DACH market.

In the followers section, OneID currently serves the UK market.

Market Leaders (in alphabetical order):

- Experian

- GBG

- HID Global

- IDEMIA

- Microsoft

- Onfido

- Ping Identity

- Thales

3 Correlated View

While the Leadership charts identify leading vendors in certain categories, many customers are looking not only for a product leader, but for a vendor that is delivering a solution that is both feature-rich and continuously improved, which would be indicated by a strong position in both the Product Leadership ranking and the Innovation Leadership ranking. Therefore, we provide the following analysis that correlates various Leadership categories and delivers an additional level of information and insight.

3.1 The Market/Product Matrix

The first of these correlated views contrasts Product Leadership and Market Leadership.

Vendors below the line have a relatively stronger product maturity in contrast with their market position, but with opportunity for growth. Vendors above the line can be considered "overperformers" when comparing Market Leadership and Product Leadership.

The correlation between market position and product maturity is close overall, with most vendors clustered near to the trend line. The Market Champions listed in alphabetical order are Experian, HID Global, IDEMIA, Ping Identity, and Thales. With relatively stronger market presence than product performance are GBG, Microsoft, and Onfido. Conversely, with stronger product performance than market presence is 1Kosmos.

Grouped near the trend line with capacity to grow both market presence and product capabilities are (in alphabetical order) iProov, OneID, Signicat, TrustBuilder, Verimi, and Yes.com.

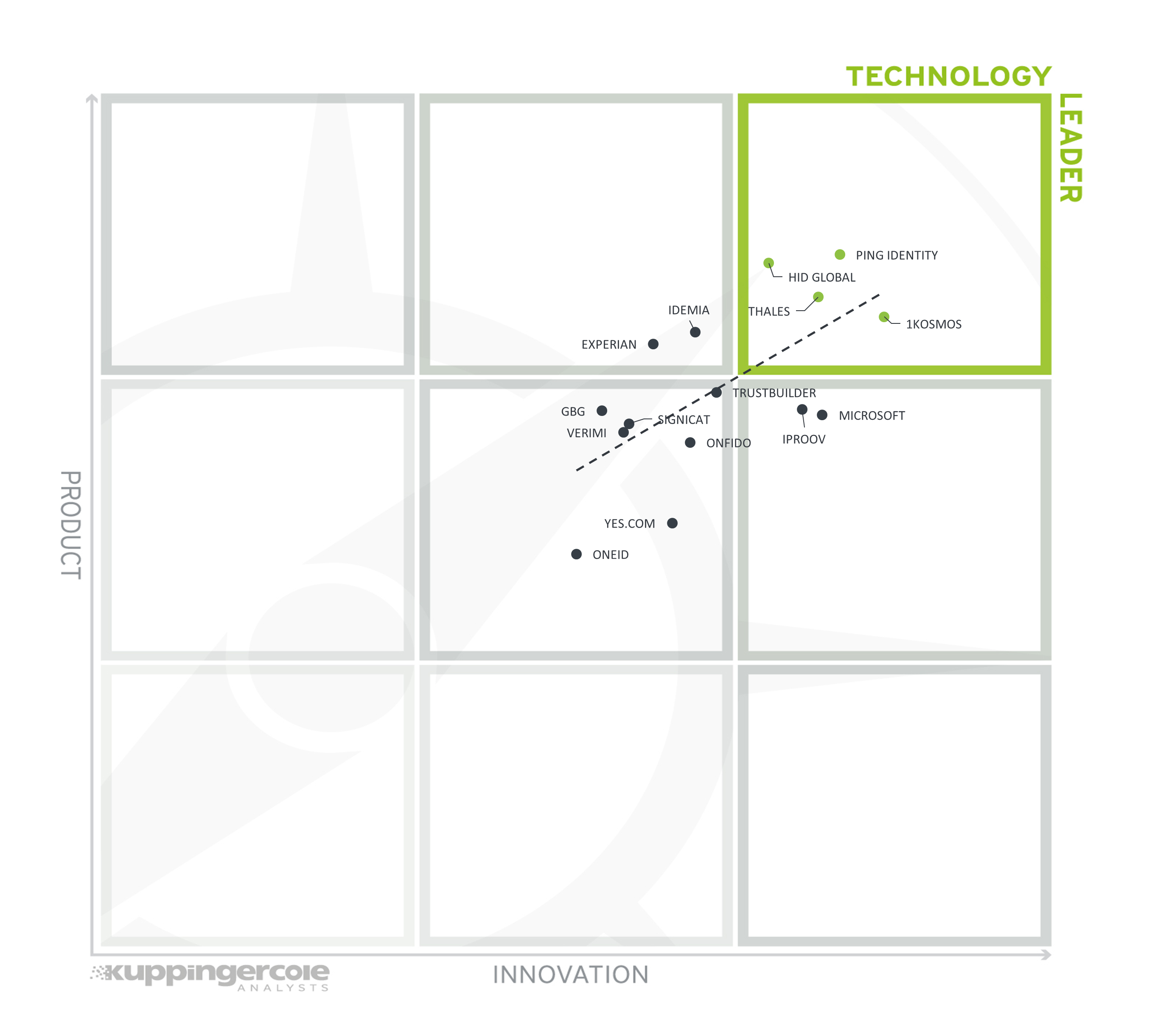

3.2 The Product/Innovation Matrix

This view shows how Product Leadership and Innovation Leadership are correlated. It is not surprising that there is a pretty good correlation between the two views with a few exceptions. The distribution and correlation are tightly constrained to the line, with a significant number of established vendors plus some smaller vendors.

Vendors below the line are more innovative, vendors above the line are, compared to the current Product Leadership positioning, less innovative.

Vendors are more spread across the matrix in this view. The technology leaders in alphabetical order are 1Kosmos, HID Global, Ping Identity, and Thales. Though vendors overperforming on the innovation side include iProov, Microsoft and Yes.com, seen far below the trend line. iProov makes its mark with biometric matching and Genuine Presence Assurance, Microsoft with its efforts to easily enable Verifiable Credentials to be issued and accepted in often used infrastructures, and Yes.com for its work on facilitating global interoperability for verified identities are all important contributions to the Providers of Verified Identity market space.

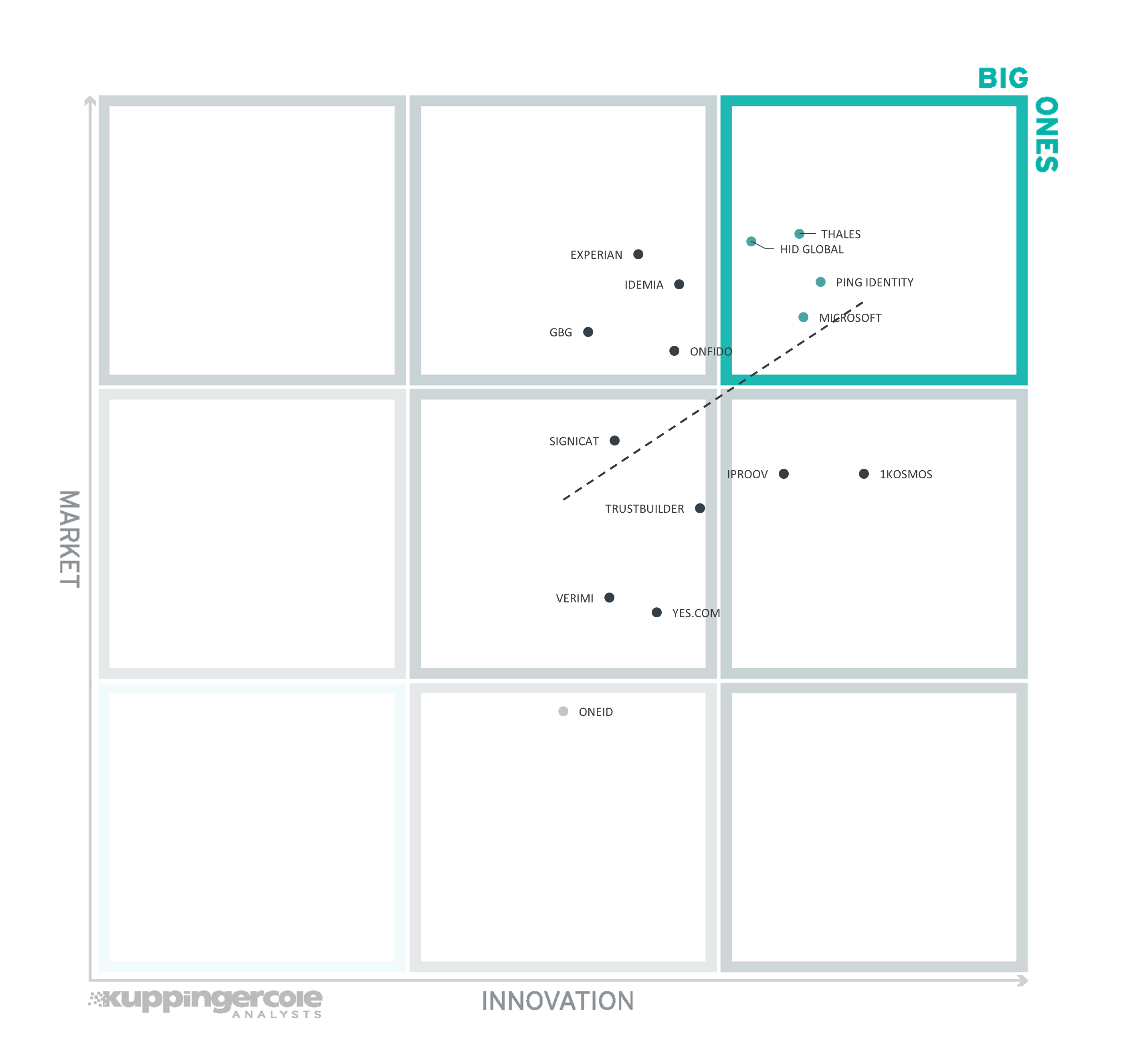

3.3 The Innovation/Market Matrix

The third matrix shows how Innovation Leadership and Market Leadership are related. Some vendors might perform well in the market without being Innovation Leaders. This might impose a risk for their future position in the market, depending on how they improve their Innovation Leadership position. On the other hand, vendors which are highly innovative have a good chance for improving their market position. However, there is always a possibility that they might also fail, especially in the case of smaller vendors.

Vendors above the line are performing well in the market as well as showing Innovation Leadership; while vendors below the line show an ability to innovate though having less market share, and thus the biggest potential for improving their market position.

The Big Ones referring to those vendors that have both market share and top innovation are in alphabetical order: HID Global, Microsoft, Ping Identity, and Thales.

Experian, IDEMIA, GBG, and Onfido have room for growth in their innovative portfolios, while 1Kosmos, iProov, Yes.com, and OneID can focus on improving their market positions to take advantage of their innovative products.

4 Products and Vendors at a Glance

This section provides an overview of the various products we have analyzed within this KuppingerCole Leadership Compass on Providers of Verified Identity. Aside from the rating overview, we provide additional comparisons that put Product Leadership, Innovation Leadership, and Market Leadership in relation to each other. These allow identifying, for instance, highly innovative but specialized vendors or local players that provide strong product features but do not have a global presence and large customer base yet.

Based on our evaluation, a comparative overview of the ratings of all the products covered in this document is shown in Table 1.

| Product | Security | Functionality | Deployment | Interoperability | Usability |

|---|---|---|---|---|---|

| 1Kosmos Block ID |  |

|

|

|

|

| Experian CrossCore |  |

|

|

|

|

| GBG PLC Id3 Global, IDScan, GreenID, Verify, and ExpectID |  |

|

|

|

|

| HID Global Identity Verification Service |  |

|

|

|

|

| IDEMIA Digital ID |  |

|

|

|

|

| iProov Face Verifier |  |

|

|

|

|

| Microsoft Entra Verified ID |  |

|

|

|

|

| OneID |  |

|

|

|

|

| Onfido Real Identity Platform |  |

|

|

|

|

| Ping Identity PingOne Verify and DaVinci |  |

|

|

|

|

| Signicat Digital Identity Platform |  |

|

|

|

|

| Thales Digital Identity and Security |  |

|

|

|

|

| TrustBuilder.io Suite |  |

|

|

|

|

| Verimi Ident, Access, Sign, Pay |  |

|

|

|

|

| Yes.com Yes Open Banking Ecosystem |  |

|

|

|

|

Table 1: Comparative overview of the ratings for the product capabilities

In addition, we provide in Table 2 an overview which also contains four additional ratings for the vendor, going beyond the product view provided in the previous section. While the rating for Financial Strength applies to the vendor, the other ratings apply to the product.

| Vendor | Innovativeness | Market Position | Financial Strength | Ecosystem |

|---|---|---|---|---|

| 1Kosmos |  |

|

|

|

| Experian |  |

|

|

|

| GBG PLC |  |

|

|

|

| HID Global |  |

|

|

|

| IDEMIA |  |

|

|

|

| iProov |  |

|

|

|

| Microsoft |  |

|

|

|

| OneID |  |

|

|

|

| Onfido |  |

|

|

|

| Ping Identity |  |

|

|

|

| Signicat |  |

|

|

|

| Thales |  |

|

|

|

| TrustBuilder |  |

|

|

|

| Verimi |  |

|

|

|

| Yes |  |

|

|

|

Table 2: Comparative overview of the ratings for vendors

5 Product/Vendor evaluation

This section contains a quick rating for every product/service we've included in this KuppingerCole Leadership Compass document. For many of the products there are additional KuppingerCole Product Reports and Executive Views available, providing more detailed information.

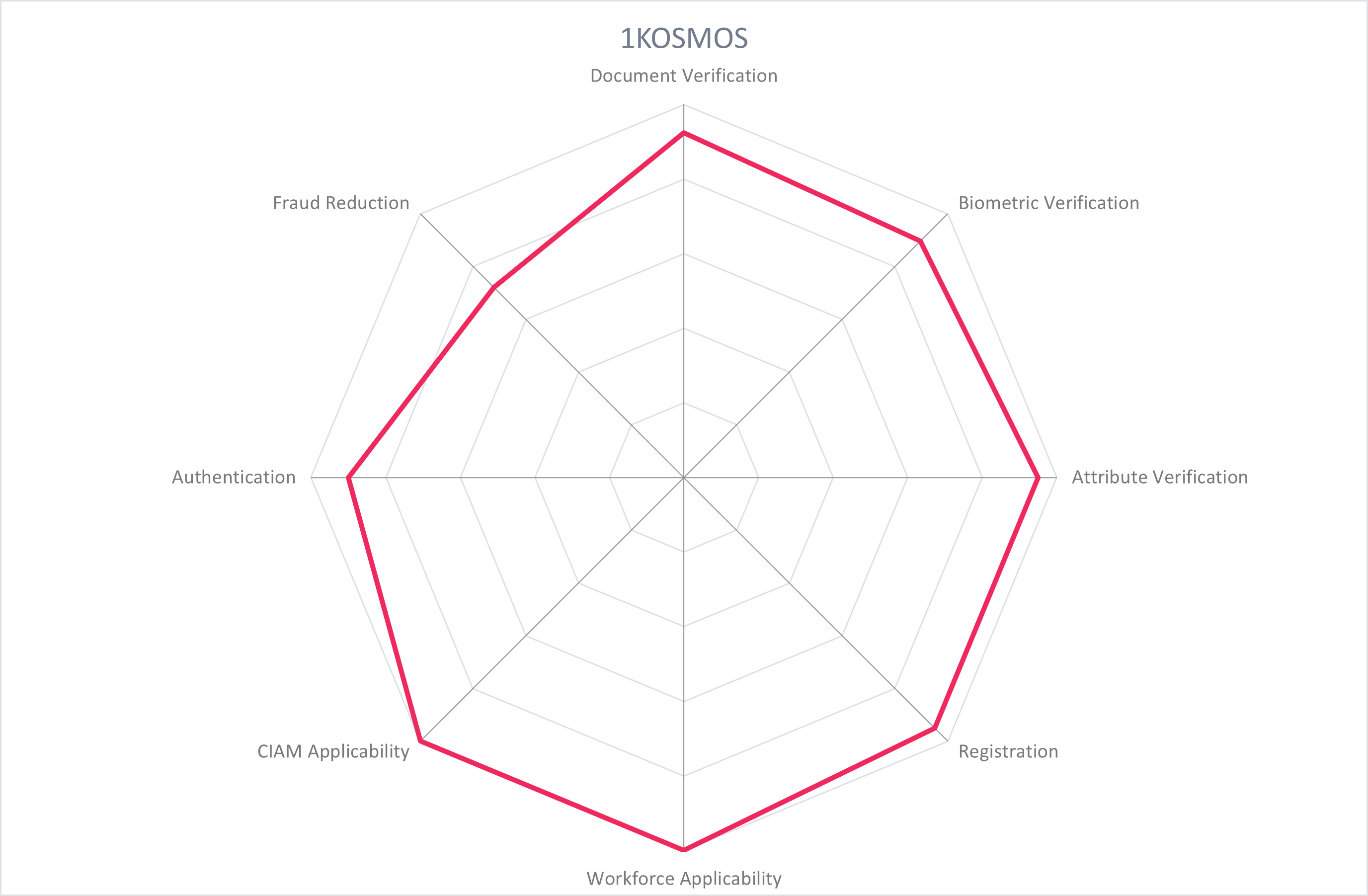

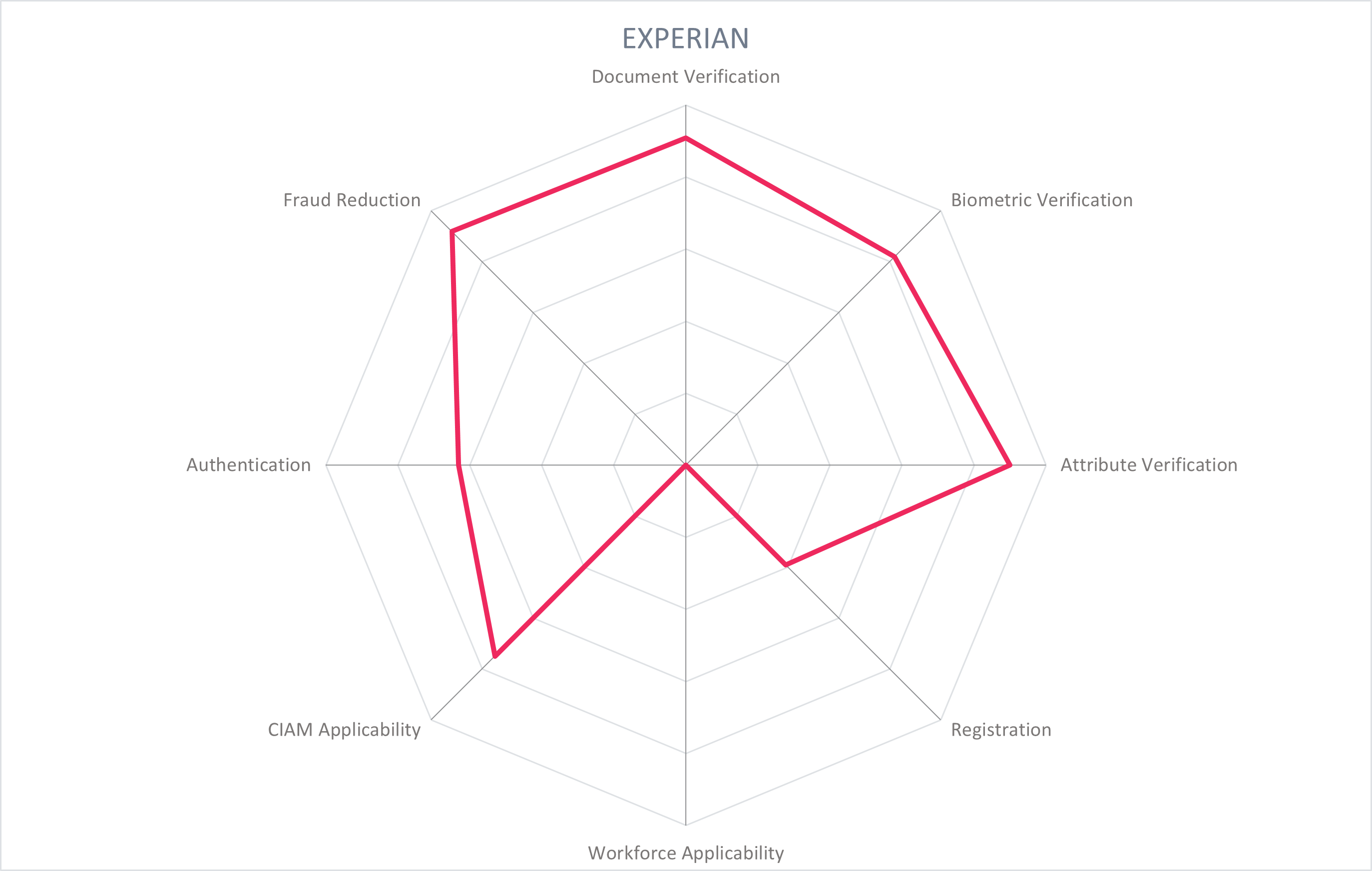

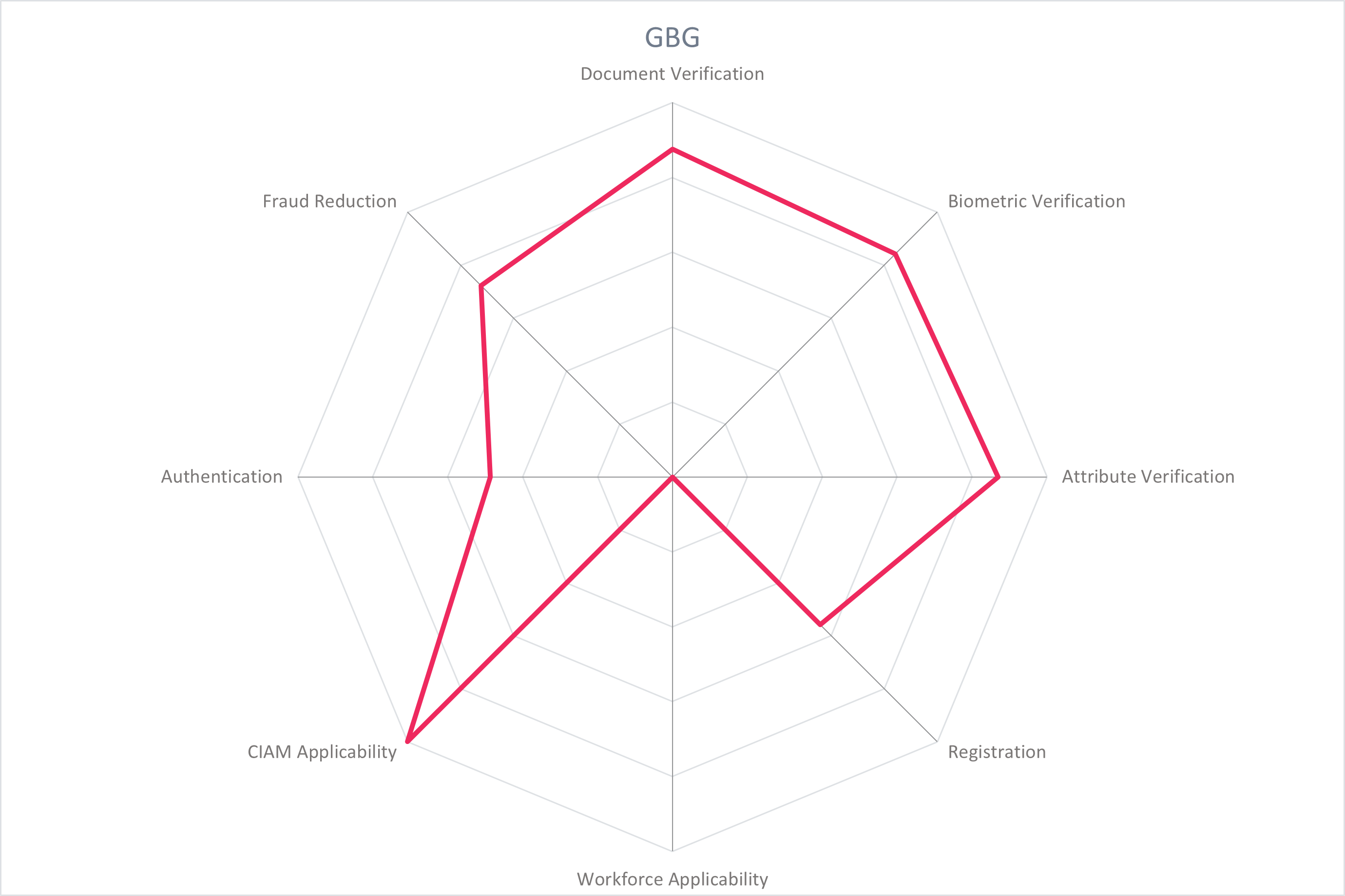

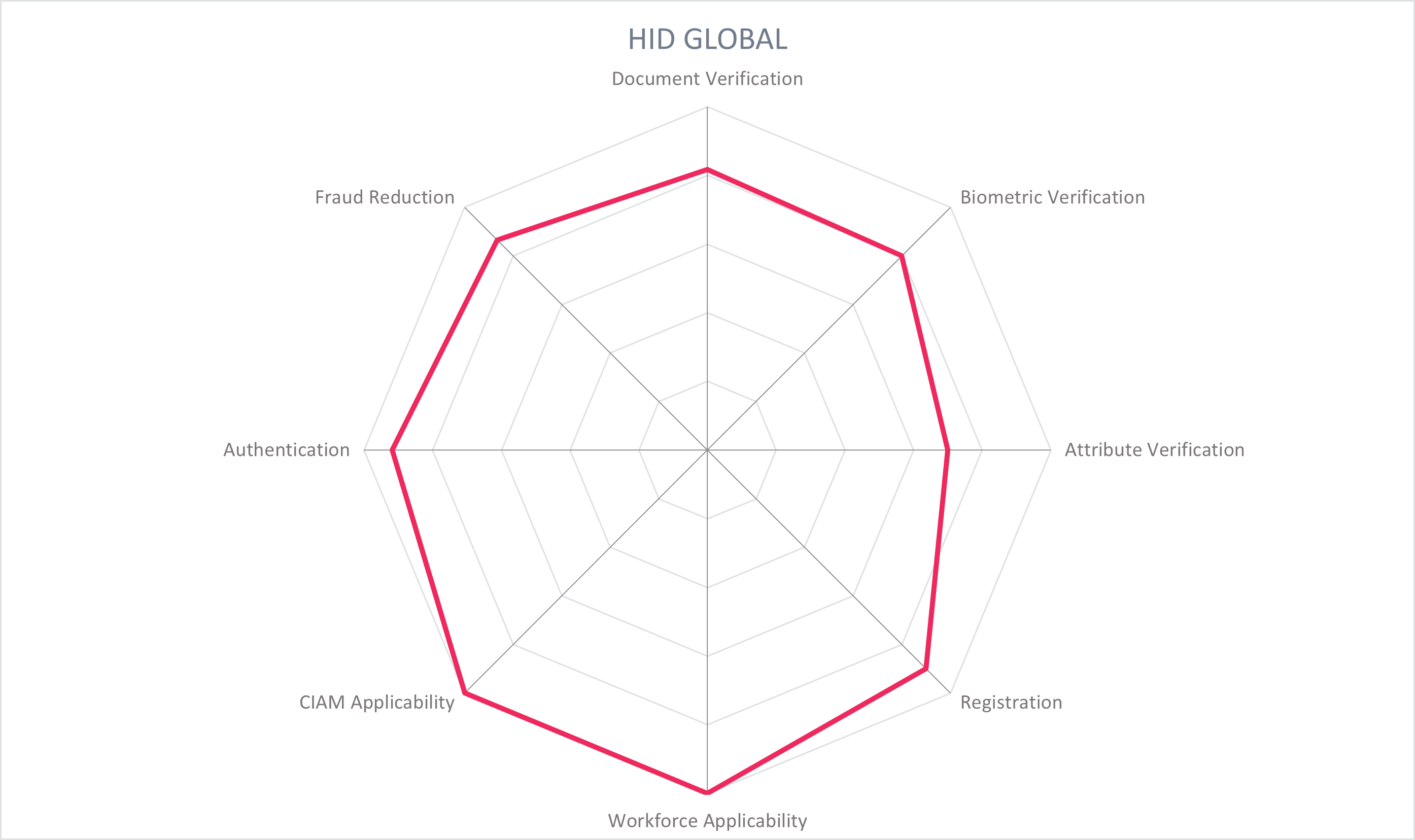

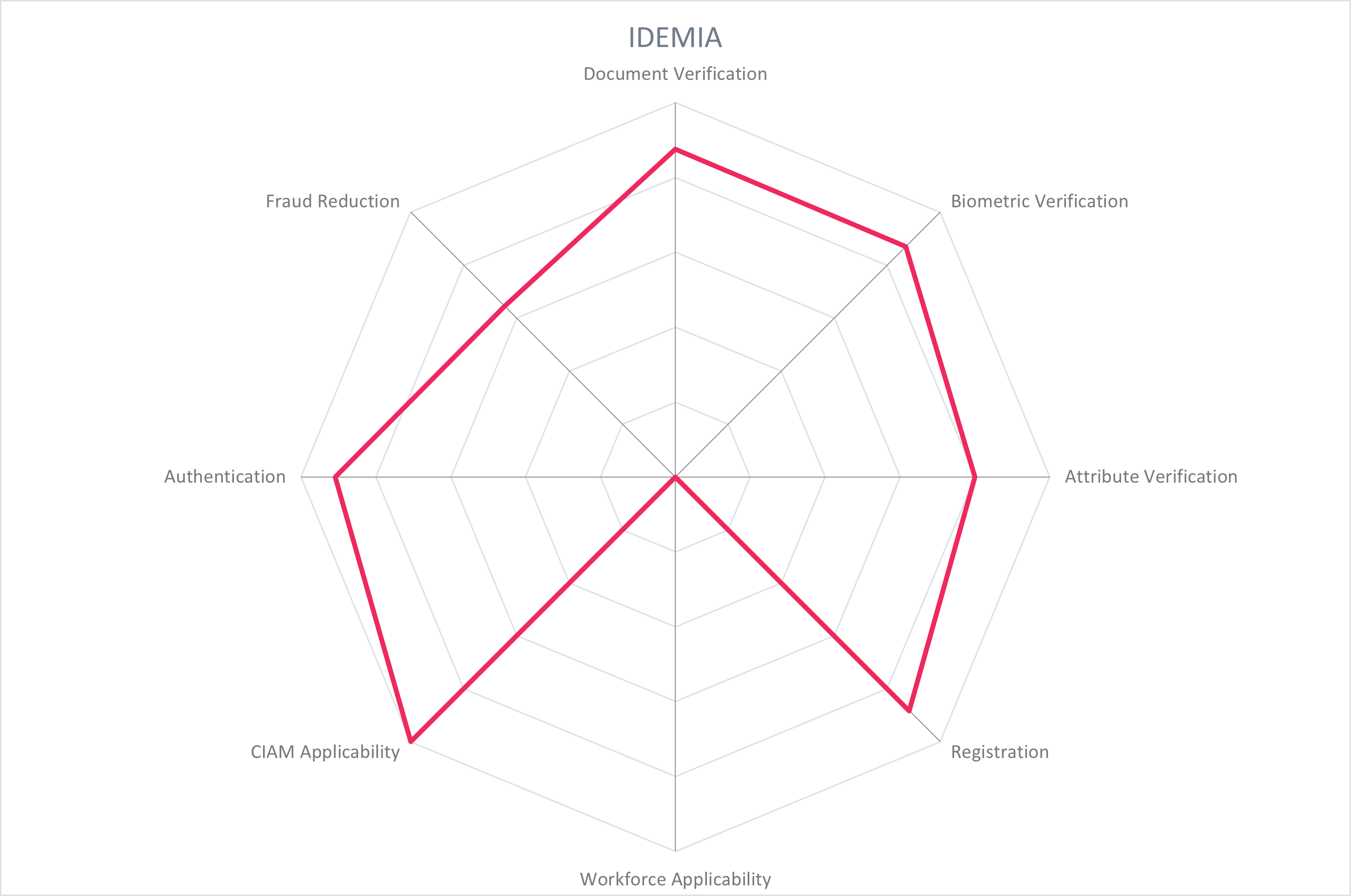

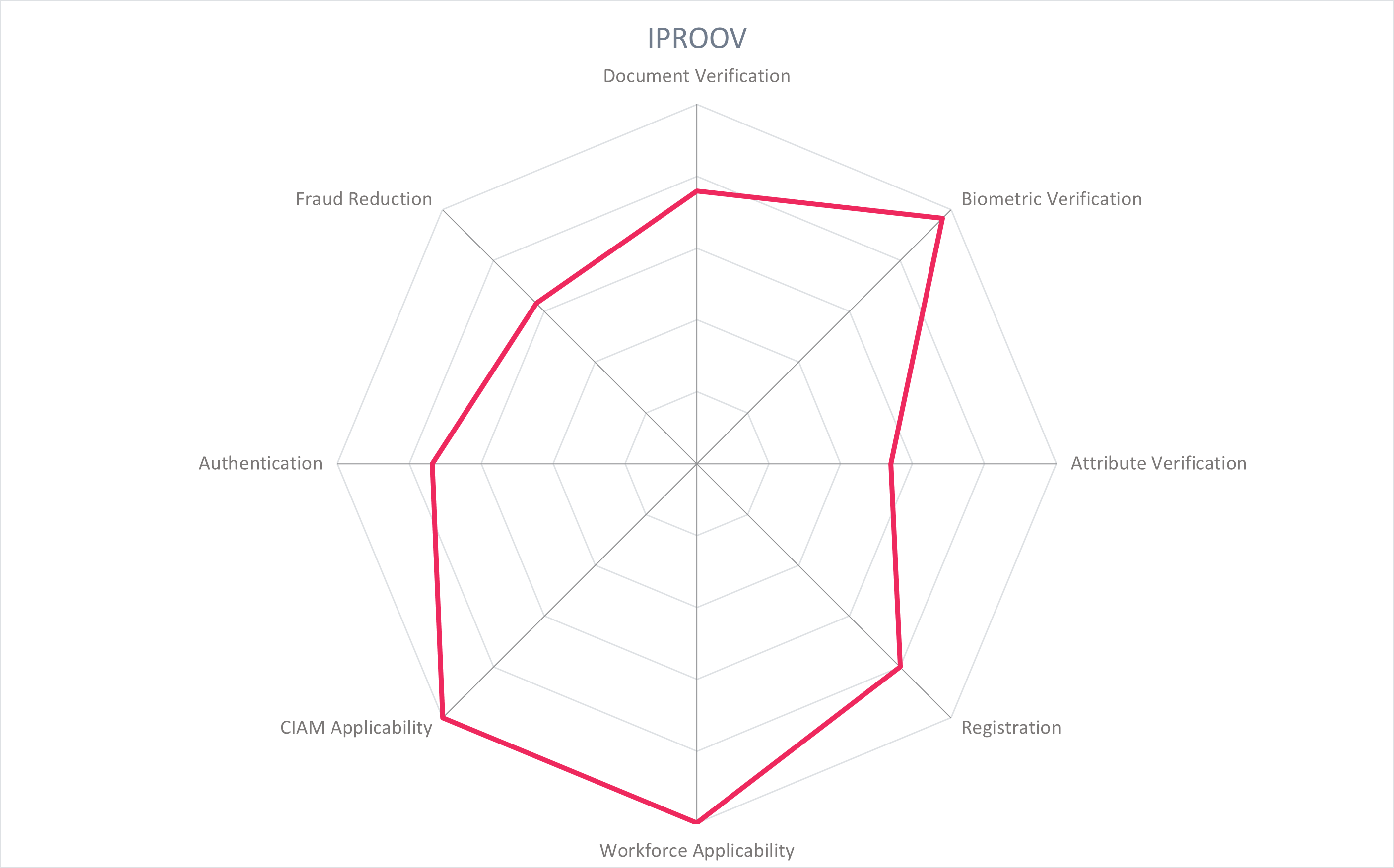

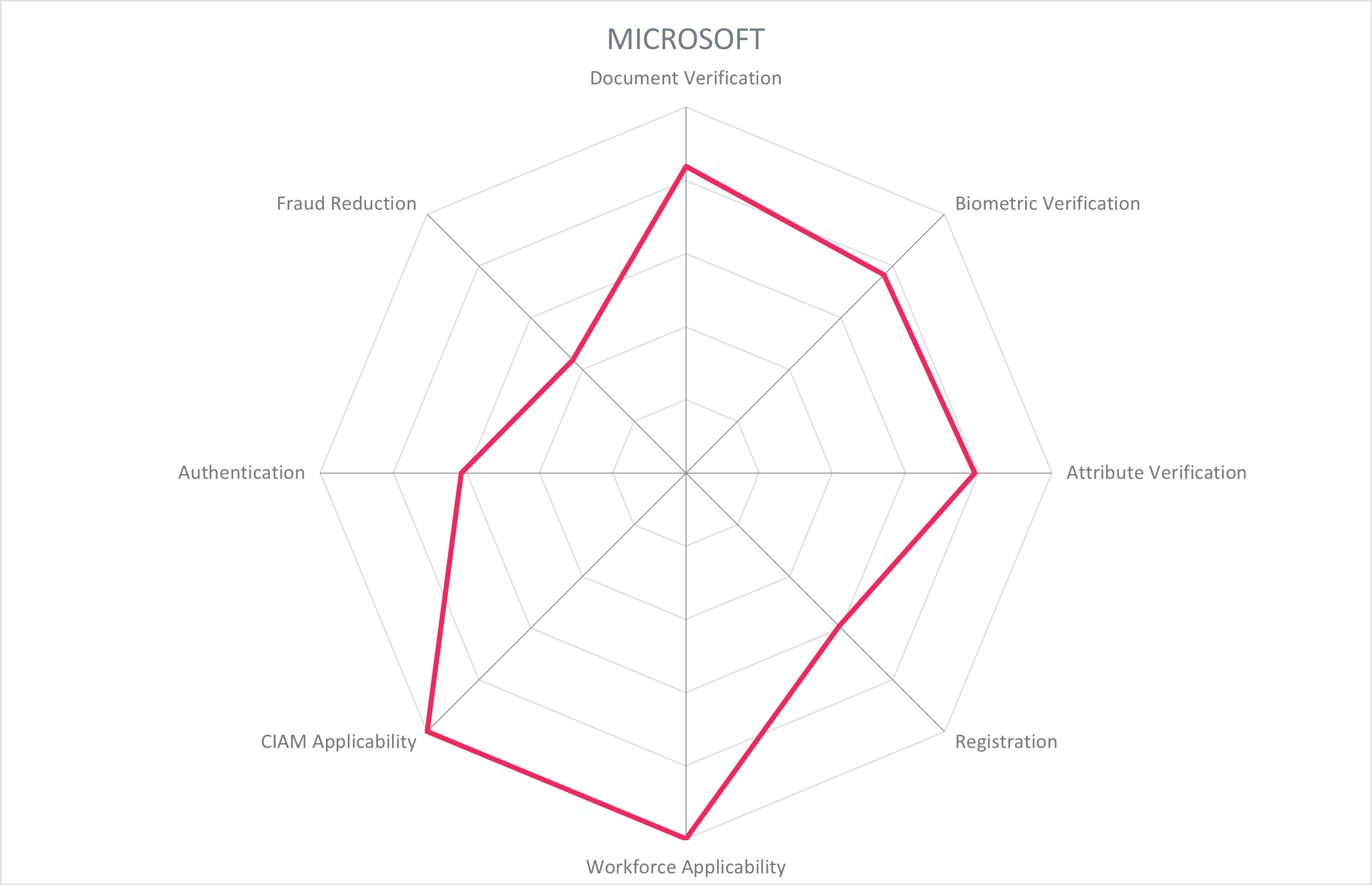

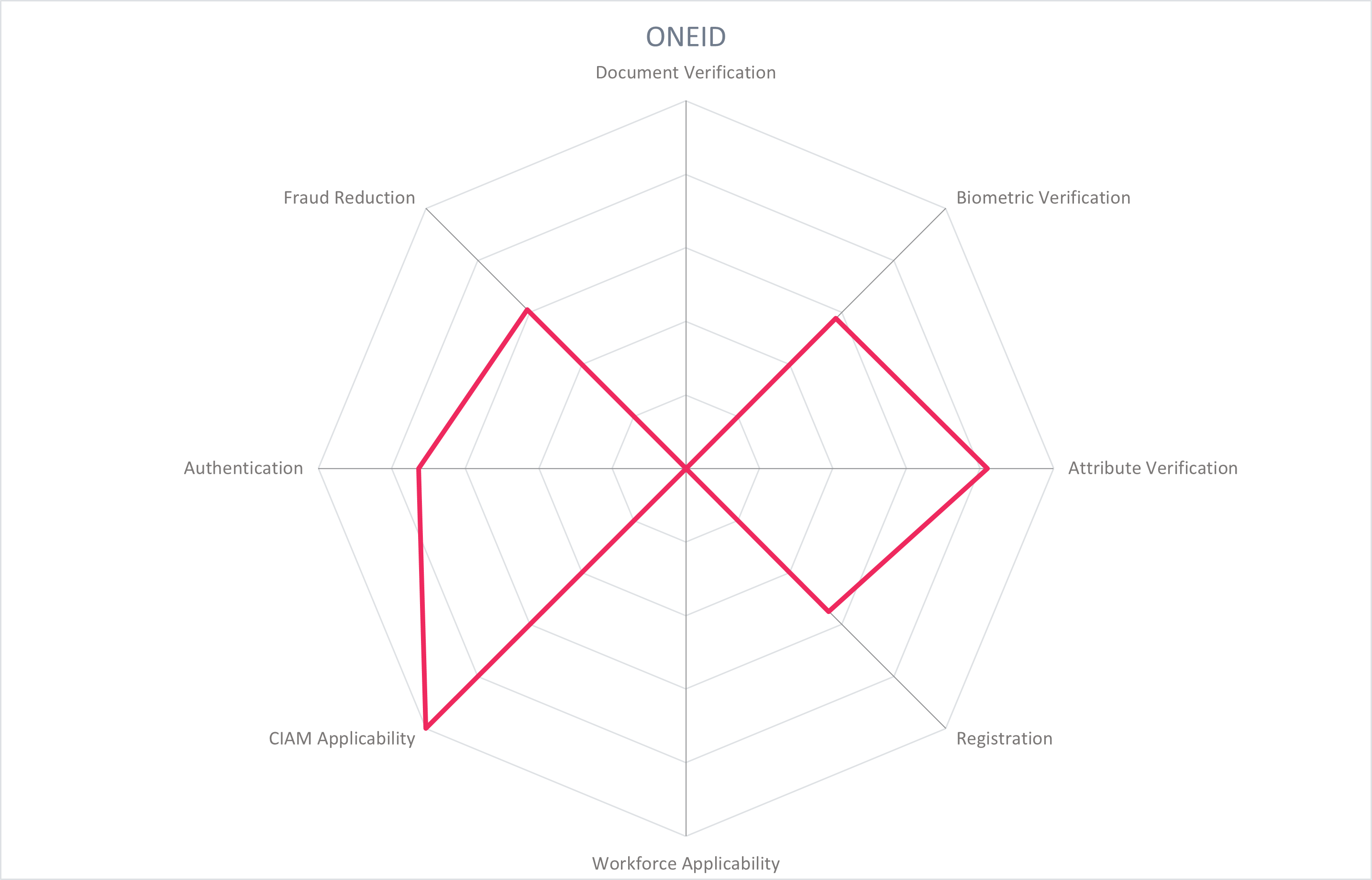

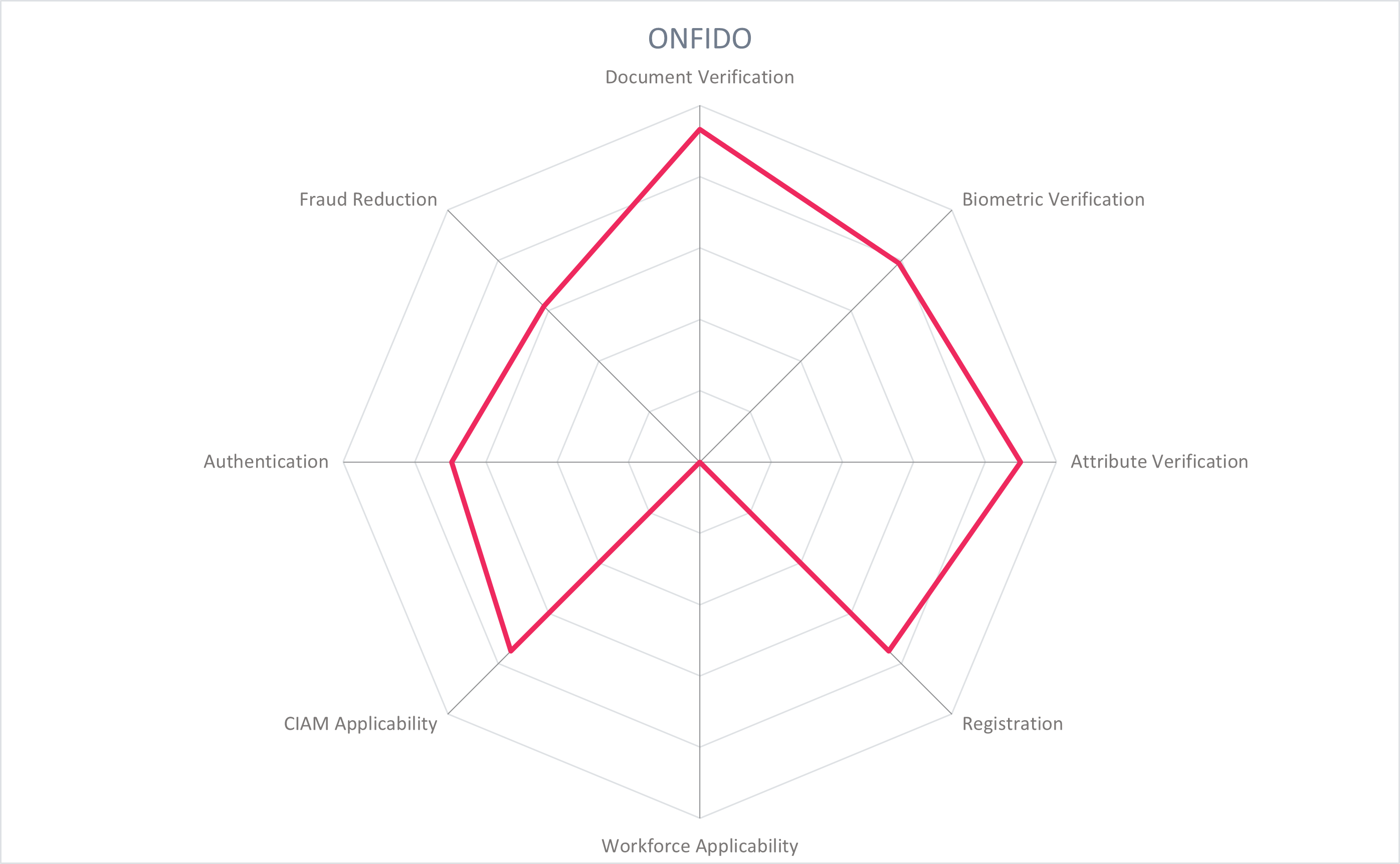

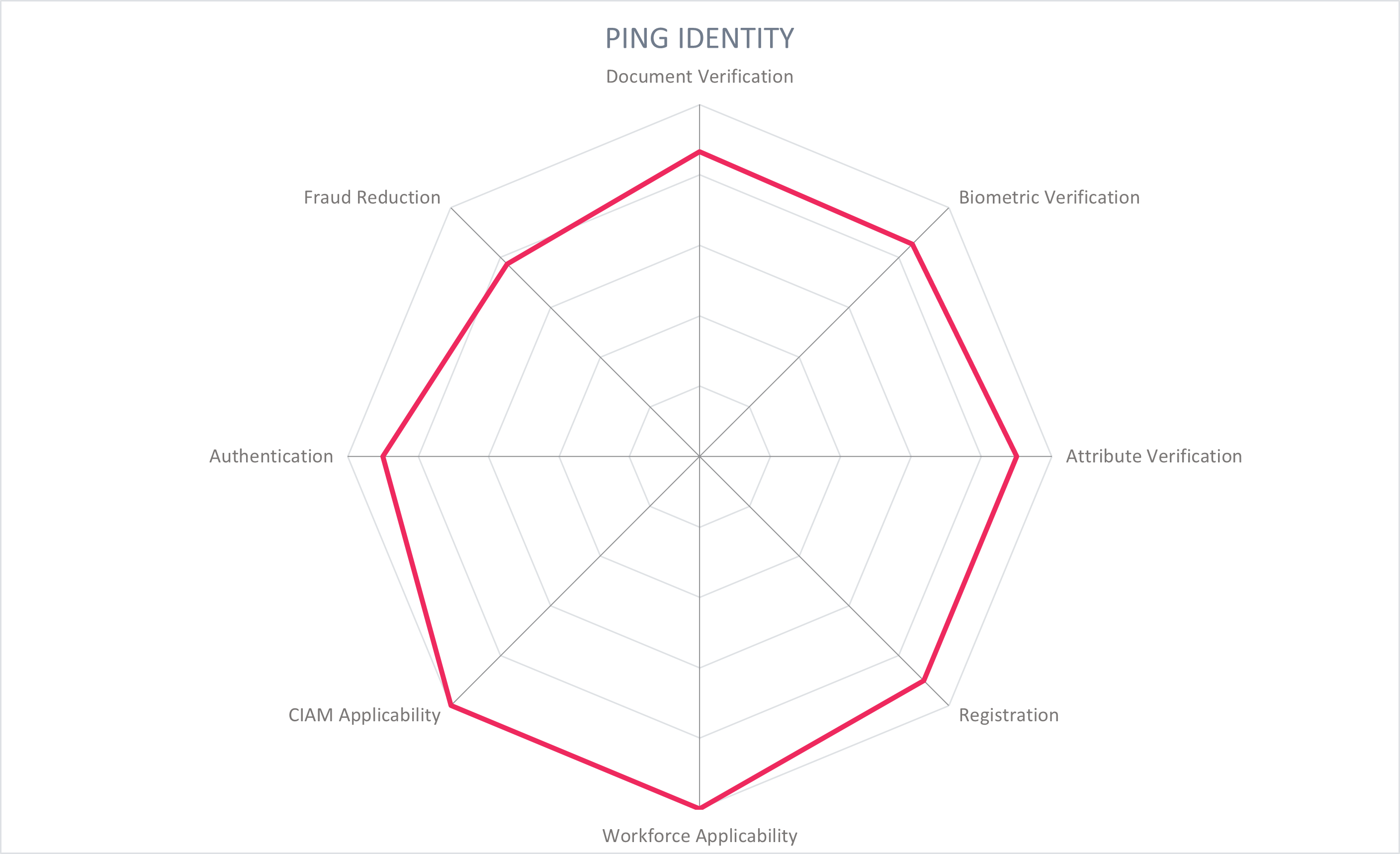

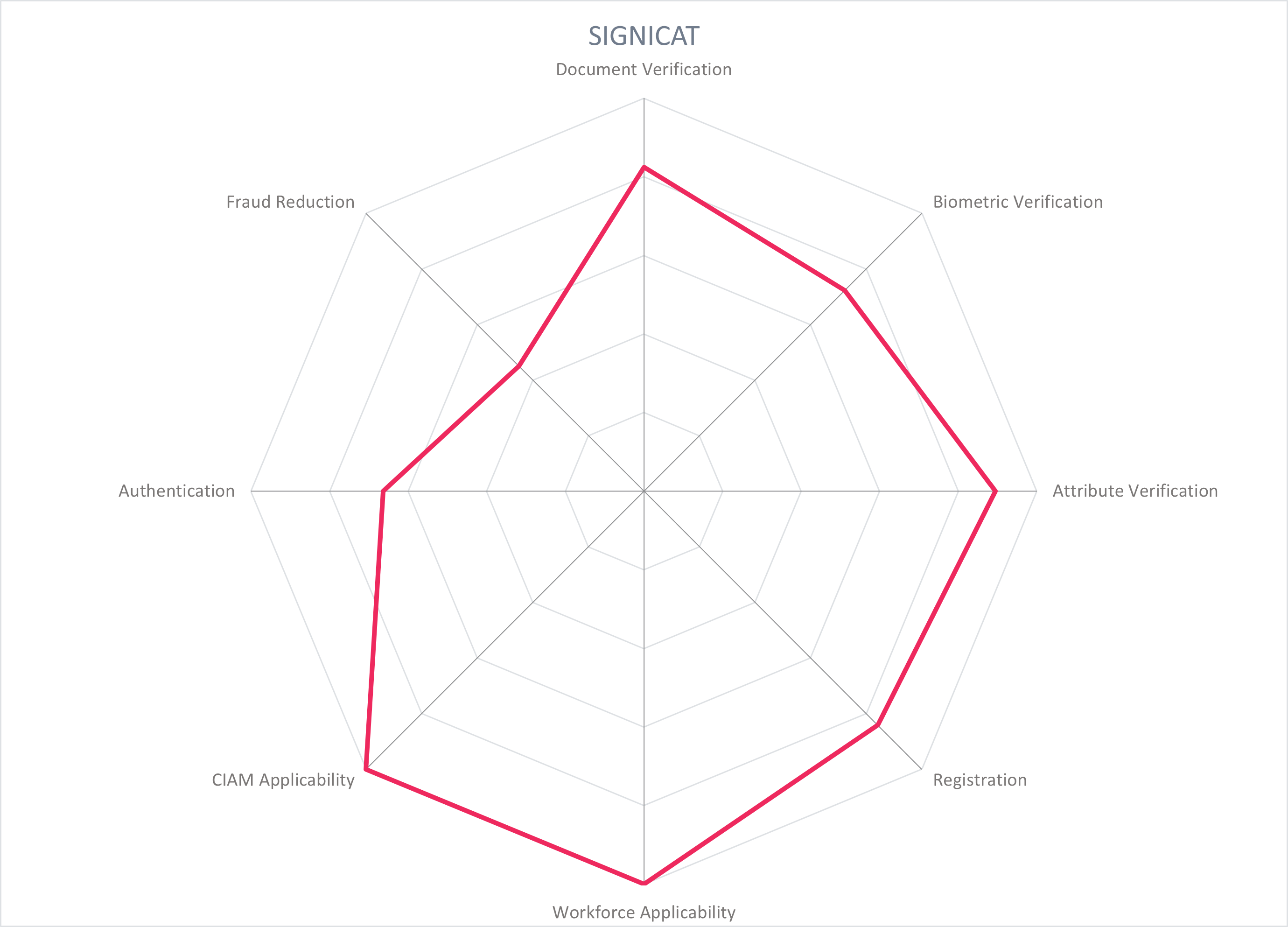

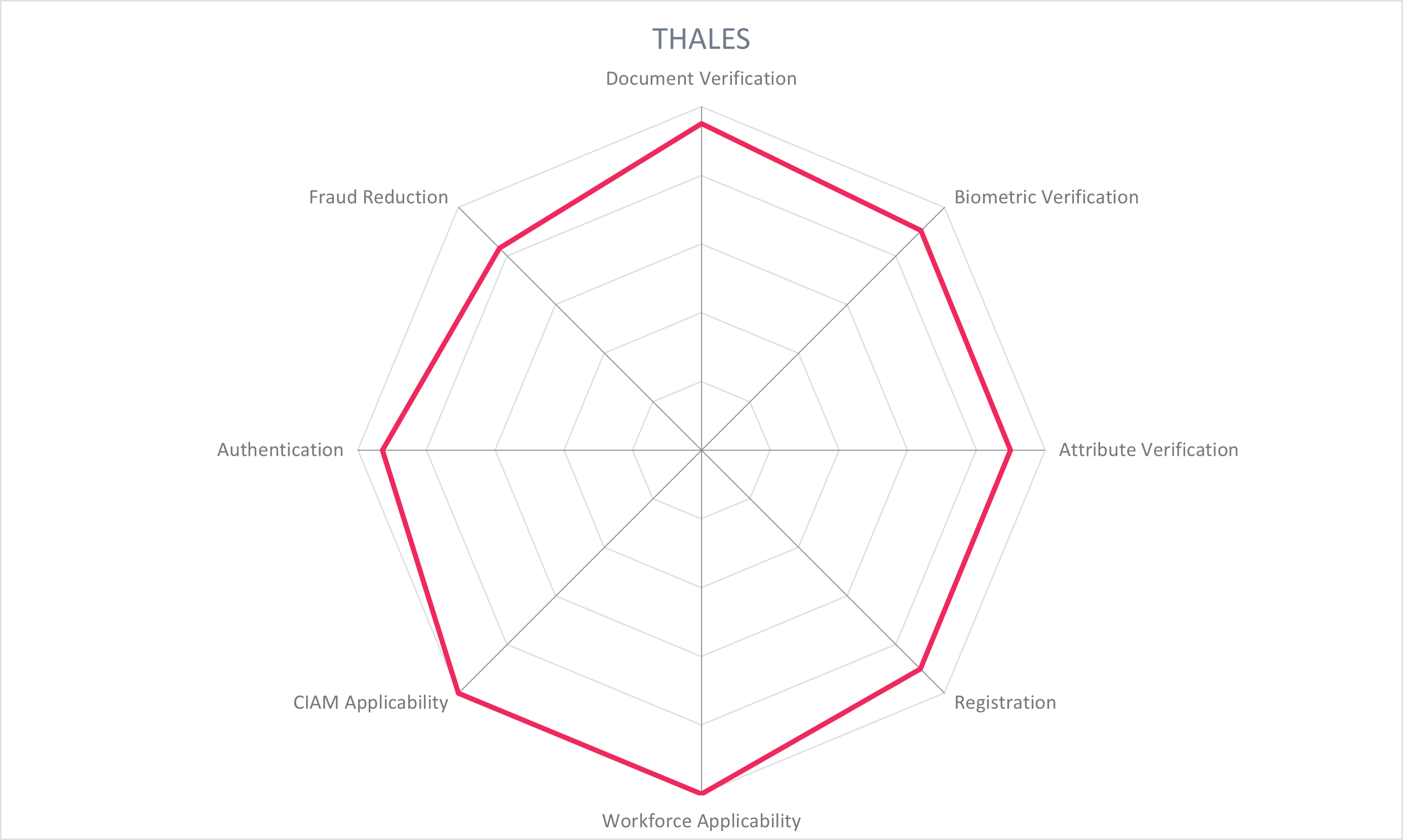

Spider graphs

In addition to the ratings for our standard categories such as Product Leadership and Innovation Leadership, we add a spider chart for every vendor we rate, looking at specific capabilities for the market segment researched in the respective Leadership Compass. For the LC Providers of Verified Identity , we look at the following six categories:

- Document Verification: Verification of government-issued and/or real-world documents. Ability to process multiple types of identity documents, from different regions, in different forms (updates, versions) and be checked for authenticity against authoritative sources such as a national registry database. Triangulate data from OCR, smartphone or hardware NFC of embedded chip, and the MRZ of identity documents to increase the confidence level that the document is valid and authentic.

- Biometric Verification: Collect and process an authoritative sample for face, voice, fingerprint, and/or behavioral biometrics for initial verification and for optional later use in authentication. Secure storage, appropriate use of 1:1 and 1:n matching for adequate privacy protection and identification purposes.

- Attribute Verification: Collect, verify, and share standard identity attributes (name, DOB, address, contact info, identification numbers, account numbers) and nontypical identity attributes (education credentials, employment credentials, health records, etc.).

- Registration: Registration of a new identity, or registration of an existing external identity. Registration refers to storage of identity attributes in the organization's directory service and filtering of identity attributes from the IdP. In the case of the latter, the solution supports BYOID for registration and later authentication via federation with reliable IdPs like BankID in the Nordics, and that is interoperable with eID schemes like eIDAS. Capabilities such as Directory User Mapping and User-Driven Federation can play a role here.

- Workforce Applicability: The solution's applicability to workforce IAM use cases, serving employees, partners, suppliers, contractors, freelancers, etc.

- CIAM Applicability: The solution's applicability to consumer IAM use cases, serving individuals and customers to access a service provider's resources and services. Should have self-service functions and the ability to synchronize accounts between devices.

- Authentication: Apply the verified identity to authentication and/or as a second factor, step-up, dynamic, etc. Authentication methods could include federation, biometric, PIN, device signals QR/Push Notifications, OTP, and others. Interoperability with authentication sources (including eID schemes, federated partners, FIDO, Windows Hello, etc.) and support of standards (OIDC, SAML) is critical.

- Fraud Reduction: Ensure that the identity documents, biometrics, attributes, or context is valid, held by the individual it describes, and not falsified through a variety of methods: IP address collection, GPS, data aggregation, sanctions lists, behavioral features, keystroke analysis, and more. Confidence scoring should provide a recommendation on the identity's reliability, and may be supported with AI/ML.

5.1 1Kosmos - BlockID Platform

1Kosmos was founded in 2018 and is headquartered in New Jersey, USA. Its BlockID Platform provides full-service identity verification, including verification of documents and biometrics, onboarding, credential issuance, credential storage, and authentication. The platform supports three products: BlockID Verify which verifies user identity and issues Verifiable Credentials, and BlockID Workforce and BlockID Customer which enable an entirely digital onboarding and authentication experience for both IAM workforce and CIAM use cases.

The BlockID Platform provides several modules that revolve around user-managed identity. First the identity is enrolled, using various methods of identity verification based on customer requirements. Next is authentication, generating authentication factors that are bound to the verified identity for passwordless experiences. The third module consists of Verifiable Credentials, providing the ability to issue, verify, and share credentials with selective disclosure. And the fourth module is storage, providing secure user-centric storage of credentials and biometric templates, protected with a user's private key and supported by a private distributed ledger. These modules are supported by standards, adhering to the NIST 800-63-3 IAL standards and eIDAS to enroll identities; FIDO, SAML, OAuth, OIDC, and NIST AAL for authentication; and W3C Verifiable Credentials and DIDs for credential issuance and storage.

BlockID Verify creates a verified digital identity for use in various onboarding, authentication, and workforce or consumer transactions. To initiate a remote onboarding process, the user is prompted by the service they are accessing (for example, an ecommerce platform) to scan a QR code with their mobile device to download a wallet app to their mobile device. A wallet app is provided by 1Kosmos, may be white-labeled, or an SDK may be used. Based on customer-defined requirements and workflows, the user is guided through document and biometric verification, while additional checks against authoritative sources, credit bureaus, and global watchlists occur in the background. For document verification, the front and back of the physical document is scanned with the user's mobile device and optionally read the embedded chip via NFC, and checked against authoritative sources. Non-physical identity attributes can also be verified and onboarded, including telco account numbers, SSN, and banking credentials. The document is verified to be held by the user it describes by onboarding facial biometrics and conducting a liveness check. Proprietary AI classifies the document and checks for various types of fraud. Once the verification is completed, 1Kosmos issues a W3C Verifiable Credential to the user, stored in their mobile ID wallet. This verification is certified by Kantara for NIST 800-63-3 Identity Assurance Level 2 and Authenticator Assurance Level 2. BlockID is also FIDO2 and NIST certified.

BlockID Workforce and BlockID Customer build off the verified identity established by BlockID Verify. These products allow employees, contractors, other externals who need workforce access, or customers to onboard a verified identity, register, and use it for passwordless authentication. Authentication methods include QR code scan, push notification, time-based OTP, biometrics, TouchID/FaceID, email and SMS codes.

BlockID Verify operates on a private permissioned distributed ledger. The user's identity and biometric data is stored encrypted on their device's secure enclave, managed by their private key. The data is also sharded and stored in IPFS, encrypted at rest and doubly encrypted in transit. Only hashes of identity verification transactions are stored on the distributed ledger. It uses atomic swap smart contracts to maintain high scalability and manage between-blockchain transactions. Users can synchronize identity data across multiple devices with a seed phrase. Additional authentication factors include a PIN, voice recognition, and fingerprint recognition. The user is required to have a smart mobile device with camera functionalities. The credential wallet app is available as a BlockID-branded app, a white-labeled app, or as an SDK. The platform and products are compatible with iOS and Android, supported by SDKs and an API Gateway for identity providers, brokers, privileged access and single sign-on service providers, and other IAM/CIAM providers.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.2 Experian - CrossCore

Experian was founded in 1996, and is based in Dublin, Ireland. It is one of the "big three" credit rating agencies, processing information on over one billion people worldwide. It provides credit history information to financial institutions, and analytics and marketing information for other customers. It also provides identity verification and fraud prevention functions with its product, CrossCore. CrossCore is a fraud detection and identity verification platform for new account registration, low and high-value transactions (both monetary and non-monetary transactions) and account management. CrossCore provides verification for incoming identity attributes from other providers for a variety of use cases and across industries by leveraging its multi-regional, credit bureau-based authenticated identity assets in products – PreciseID in North America, ID Authenticate in the UK, ProveID in EMEA - along with its proprietary device intelligence and additional partner data and insights. Experian's geographical reach enables identity verification globally.

CrossCore is a platform that provides verification, ranging from attribute verification, document verification, behavioral biometrics, and business verification with a strong fraud prevention aspect. Crosscore analyzes user data during input, generates a fraud risk score, assesses KYC and CIP risk for compliance, and yields a decision to accept or to require additional verification. As an authoritative attribute provider, Experian offers comprehensive identity proofing services with bi-directional links to various government agencies and financial institutions and partnerships with vendors of app-based remote document verification with liveness detection functions, behavioral and traditional biometric capabilities, email verification, alternative identity data, and mobile verification solutions. Partners include Acuant, Daon, Prove, IDfy, Mitek, eMailage, Ekata, BioCatch, GDC, Boku, and RapidID.

The user inputs their data for onboarding or application screening, and if required, may also prompt a scan of government-issued ID and a selfie for liveness detection which is scored by a collection of first-party and third-party fraud and verification applications. Fraud detection includes account compromise confidence scores, credit reporting, detection of synthetic identities, behavioral biometrics, device and context intelligence, and consistency of identity elements in transactions. This process is supported by its growing database of over 1 billion authenticated identity data assets. The user is then segmented into an appropriate risk group for either successful acceptance or an additional step-up verification before acceptance. This solution achieves up to eIDAS High NIST 800-63-3 IAL2 for Levels of Assurance, able to dial the level up or down based on the use case. CrossCore does enable authentication, but not necessarily using authenticators based on the verified identity.

CrossCore is a SaaS platform. Locations of data centers include US, UK, Germany, Spain, Brazil, Singapore, India, South Africa, and Australia. Data storage is compliant with the requirements of financial and government regulated industries, thus the system is configurable to meet the data storage needs of the customer. Experian supports the range of traditional remote and digital verification procedures for both low and high value transactions, including call center verification with knowledge-based questions.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.3 GBG PLC - Id3 Global, IDScan, GreenID, Verify, and ExpectID

GBG PLC was founded in 1989 and is headquartered in Chester, UK. Globally, it provides solutions on fraud, location, and identity data intelligence. Identity verification is one aspect of GBG's product offerings, which is comprised of several acquisitions - IDology, Acuant, and GreenID - along with GBG's in-house capabilities. GBG's identity verification solutions primarily serve consumer IAM use cases

GBG is able to support in-person and virtual verification. The capabilities include data and document verification, biometric verification, attribute verification (including date of birth, address, mobile, email, bank account, and national identity numbers), fraud and AML screenings, and authentication. While integration between all identity product offerings is still in process, the Global GBG Platform gives customers an end-to-end verification and onboarding experience with use of the GBG Global Network for verification decisions. Fuller integration with IDology, Id3, and GreenID on the roadmap and stand-alone document and biometric verification solutions from GBG and Acuant are in process of being integrated. For document verification, GBG's combined product offerings have a document library of over 6,000 document types and coverage of over 200 countries, with a suite of third-party biometrics partners, proprietary NFC functionality, verification of template-less documents, and more.

GBG's identity verification products can achieve eIDAS High and NIST IAL3, as well as UK GPG 45. To verify an identity, the user scans their identity document, processes the MRZ, and can read an embedded chip using NFC of the mobile device. Document verification is provided by in-house technology and partners for any manual review that is required by the customer. This is supported by biometric verification and active and passive liveness. Only 1:1 facial matching is used for the solutions, provided by technology partners. Attribute verification and AML screening including PEPs and sanctions lists can also be integrated in the user flows. Attributes are verified by checking against national registries, aggregating data from a variety of sources, via Verifiable Credentials, or via the proprietary eDNA which utilizes machine learning to make a decision whether there is a government source of truth or not.

An administrative view provides an overview of which steps the user passes - document, correlation with data on embedded chip, and liveness - as well as insights into analytics and user journeys. The orchestrator allows for streamlined customization of different requirements for different transaction types, ranging from identity document scans with OCR only, use of NFC, and active liveness detection, facial matching, health passes, Verifiable Credentials, etc.

GBG document and biometric verification solutions are primarily SaaS products with public cloud, private cloud, desktop, hardware, self-hosted use cases, but also supporting on-premises deployments. These deployment options are omni-channel with mobile, mobile web, desktop, kiosk, terminal, and scanner options. Most major cloud vendors are supported and is cloud agnostic. It takes a microservice approach and uses containers for deployment pipelines. Data centers are in Australia, US, Ireland, and Germany. SDKs are available for customer to configure the solutions into their own UIs.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.4 HID Global - Identity Verification Service

HID Global, part of the ASSA ABLOY group, was founded in 1991 and is based in Austin, Texas, USA. HID Global provides IAM solutions, and also designs and prints passports, produces physical access controls systems, RFID tags and readers, biometric readers, and mobile apps capable of remote identity verification. Their intersection of IAM, biometrics, and SDKs allows them to perform identity card issuance for numerous organizations. The Identity Verification Service, supported by the Authentication Platform and Risk Management Solution, offers fraud prevention components including ID proofing, credential and device intelligence, behavioral biometrics, user behavioral analytics (UBA), and bot detection.

HID Global provides identity assurance verification and credential issuance services. Government and enterprise customers can utilize HID Global for authoritative lookups, remote document verification, and electronic credential assignment. For remote identity proofing scenarios, users utilize the smartphone app to scan and register the authoritative documents, take selfies, and perform real-time biometric matching. HID can assess the validity of over 13,000 documents, checking against government agencies or using ML to assess the documents. Users initiate and complete identity verification via the customer website or app, supported by SDKs. Users provide requested information with manual data entry, or auto-filled forms and scan their government-issued identity document with OCR and read the MRZ, and conduct onboarding and a liveness check. The facial biometric template that is onboarded is matched against the photo in the identity document. Parallel to these steps, HID captures device identifiers and other risk factors and determines a level of risk associated with the identity verification transaction. Once these processes are passed, an account is opened for the user and credentials can be issued.

When the user returns to the customer's platform, they may authenticate using HID's Authentication Platform, which supports a variety of authenticators, one of the options being to use the biometric template collected at onboarding to leverage the identity verification process for authentication – this depends on customer preferences for storage and retention of biometric templates. The Authentication Platform utilizes in-network compromised credential intelligence with support from the Risk Management Solution. When the user accesses the customer app via their mobile device, passive authentication can be used with indicators of location, device, time, presence of (or lack of) malware. A risk score is calculated and a decision is made based on the customer's thresholds and weights assigned to risk attributes. The score output ranges from 0-1000 with four major action recommendations. The policy authoring interface is flow-chart driven. The fraud analyst interface is very intuitive and includes a detailed timeline view to expedite investigations. The solution does not offer integration with 3rd-party ITSM or SIEM systems. Customer apps communicate via REST APIs. JWT, OAuth, OIDC, and SAML can be used for API authentication. External feeds of compromised credential intelligence are not yet considered. HID Global's UBA functions encompass full transaction history details. Per-tenant crypto keys are managed to promote maximum data security.

HID Global is a market leader in authentication solutions. Their focus is on B2C use cases in the finance and healthcare industries and providing G2C solutions for government agencies around the world. In fact, some implementation partners package HID Global Authentication Platform to serve as the consumer front-end for their "bank-in-a-box" offerings. HID Global attests and/or has certified on FIPS 140-2, ISO 27001, ISO 27018, SOC 2 Type 1 and SOC2 Type 2. Inclusion of 3rd-party intelligence sources in the risk evaluation would strengthen the offering.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.5 IDEMIA - Digital ID

IDEMIA is the product of a history of mergers and acquisitions with over 70 years of experience in identity. It exists in its current for since 2017, and is headquartered in Paris, France. IDEMIA works with governments and businesses to provide secure identity services, including issuing citizen identity documents, smart cards, biometric terminals, SIM cards, and identity verification. The Digital ID ecosystem serves governments with several nation-wide deployments including USA (with Oklahoma, Delaware, Arizona, Mississppi, with others to come), Colombia, Chile, France, and Morocco. It also serves commercial enterprises and particular use case groups like law enforcement and the US Transportation Security Agency (TSA), and covers identity proofing and verification, digital wallets and integrations, orchestration layers, and more.

The Digital ID suite covers many offerings and modules, one of them being the Identity Proofing and Verification which leverages in-house and partner technology for document and biometric verification along with confirmation against authoritative systems of records. The user first scans their identity document with a mobile device, where various fraud checks are made for known forgeries, screenshots, holograms, fonts, image manipulation, and more. IDEMIA provides worldwide coverage for multiple types of identity documents, including passports, driving licenses, residence permits, etc., and has the use of OCR and NFC. The data from the document is extracted and checked against the appropriate system of record, including national registries, credit bureaus, telecom, banks, watchlists, sanctions lists, and PEP lists. The user takes a selfie, conducts an active liveness test by following a prompt to nod their head. If necessary, synchronous video verification and other manual methods can be added to the user flow.

IDEMIA's biometric face matching algorithms are regularly tested by NIST FVRT, with high performance and low-undetected demographic variance. For Digital ID usages, biometric facial recognition is only used in a 1:1 manner. The verification products are able to achieve NIST 800-63-3 assurance level 2 and eIDAS High. User data is stored either in the user's mobile device, or in an authoritative system of record, and any data used during an identity verification session is deleted in the IDEMIA backend after the transaction. Attribute verification is done through checks against national registries, verifying Verifiable Credentials, and aggregating data from authoritative sources such as credit bureaus, telecom, banks, watchlists, sanctions lists, and PEP lists.

A digital identity that has been onboarded can be stored in a user mobile wallet. This can be provided by IDEMIA, integrated with web or native SDKs with customer applications, or utilize Apple Wallet. In person and online identity verification and identity data exchange can be facilitated. To share identity information with a relying party in-person, the user opens their wallet app and selects "share ID" and a QR code is presented for the relying party to scan. The relying party uses IDEMIA's Verify App (or SDK for custom integration) to scan the QR code, and establish a secure communication channel. The user views and approves the identity attributes to be shared with the relying party, which are sent to the relying party using BLE upon approval. The Verify App validates the incoming data, selfie, and other collected information needed during the transaction. To share data and verify the user remotely, the user scans a QR code on the relying party's website to initiate the verification. The user receives a request on their mobile wallet to approve the selected identity attributes to share. The user journey is based on the level of security required by the customer, and could include a selfie and liveness detection or other aspects. The user journey can also be adjusted to suit authentication use cases.

IDEMIA's products are available on premises and as SaaS. Support for Verifiable Credentials is being built out, as well as support for other decentralized wallets. IDEMIA's identity verification solution and experience in the identity issuance and verification space make it a strong option for a full-service provider of verified identity.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.6 iProov - iProov Face Verifier

iProov was founded in 2013 and is headquartered in London, UK. Its Biometric Face Verification, Genuine Presence Assurance, and Liveness Assurance technologies support a suite of products: iProov Enroller, iProov Face Verifier, and iProov Basic Face Verifier. iProov is a focused biometric verification vendor that is supported by partners to complete document verification, attribute verification, authentication, and orchestration for a full-service identity verification solution.

iProov Enroller works with partners to scan and verify the user's identity document using OCR and NFC to intake and analyze data. Upon verification, the photo from the identity document is shared with iProov and synchronized keys stored with the customer, with defined data retention policies and encrypted at rest and in transit. The biometric components are handled by iProov's proprietary technology: The user takes a selfie which is matched to the photo extracted from the identity document. This biometric template, stored with iProov, is the basis to establish liveness and genuine presence, and to later authenticate.

iProov's Face Verifier (both basic and regular versions) use the onboarded biometric template for future authentications and transactions. Basic Face Verifier uses iProov's face matching and fraud detection algorithms to determine if the user is the one described in the identity document for liveness detection. The Genuine Presence Assurance product adds an additional layer of protection against deepfakes or digital injection attacks. It uses iProov's patented Flashmark technology to generate a one-time biometric that cannot be reused or falsified to ensure that the user is present during the transaction. While the user takes a selfie of themselves, a sequence of colored light is reflected on their face. Along with the typical facial matching between a biometric template or identity document, the sequence of colors is analyzed to ensure that no malicious file was injected such as deepfakes or presentation attacks. The product conforms to eIDAS High. The biometric profile can be stored by iProov for future authentication.

The Liveness Assurance and Genuine Presence Assurance products both use a selfie abstraction feature to reduce drop-off and selfie retakes. By presenting the selfie as a sketch and not as a realistic photo, the user is less likely to be judgmental of their appearance and retake the selfie unnecessarily. The products are cloud-based – including authentication – which allows users to authenticate using different devices without having to enroll a new device. 1:1 facial matching is used for the solutions.

iProov products are deployed as cloud or managed services with support for multi-cloud, multi-tenant environments and the major cloud providers. An SDK is provided to integrate iProov verification into the customer's applications, inclusive of mobile, desktops, laptops, tablets, and kiosks. Customization is primarily used for specialized user journeys, and roll-out time is typically a few days to weeks depending on customer requirements. Data centers are in the UK, Netherlands, Australia, USA, and Singapore, with instances in other regions provided as necessary. iProov adheres to GDPR principles.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.7 Microsoft - Microsoft Entra Verified ID

Microsoft, founded in 1975 and based in Redmond, USA, is a familiar figure in hardware and software, digital services, and cloud infrastructure businesses. In August 2022, Microsoft has released Entra Verified ID product (based on Verifiable Credentials and Decentralized Identifiers) as generally availabile after over a year in public preview. Its Entra Verified ID product enables peer-to-peer, B2C, and B2B verified credential issuance, storage, exchange, and verification for consumer and workforce use cases. Through its contributions to open-source DID and Verifiable Credential standards, Microsoft enables reusable verified identity for use in Azure Active Directory services for remote onboarding, authentication, and user-centric management of identity attributes. Microsoft is a key player in this market and serves customers globally.

Microsoft enables an organization to issue and accept Verifiable Credentials (VCs) for users, employees, partners, etc. These VCs can be supported by identity proofing that is conducted by partners for document verification, biometric verification, and liveness detection for the customer's desired level of assurance. Using the open-source Verifiable Credentials SDK from Microsoft, the VC issuer service is federated with the organization's IdP using OpenID Connect, allowing the organization to populate VCs with relevant identity claims and issue them to both internal and external parties.

To issue a VC, the organization federates to the organization's IdP to authenticate the user, establishes a per-organization identifier, and processes the identity attributes to be included in the VC which can include government-issued documents, facial and/or fingerprint biometrics, liveness, or other attributes. The result of the ID proofing flow is the issuance of a Verifiable Credential to the user, employee, or partner for reuse with the issuing organization or with external organizations. In a remote onboarding use case, an organization using Azure AD hires a remote employee who is sent a link to the Employee Portal for onboarding. The employee verifies their identity with a combination of document scan, biometric, and liveness detection and requests their employee ID card. The employee scans a QR code creating a secure connection to their Microsoft Authenticator app, and the employee credential is sent and stored in the user's device.

The enterprise manages access rights from the Azure AD-integrated Verifiable Credential service, and employees can request access to resources with their employment credential. The organization has the ability to define the identity attributes required for specific interactions, such as authentication to a particular resource. Onboarding an employee with VCs eliminates provisioning a username/password but allows employee to reuse the VC for verification of identity attributes in other flows, with the Microsoft Authenticator app also functioning as a digital wallet.

The product is a SaaS service able to be deployed on all major cloud platforms. DIDs are anchored in ION, an open, public, permissionless Layer 2 Decentralized Identifier network, as well as web servers. Identity data is stored encrypted on the user's device and is only disclosed for verification by others when the user chooses to do so.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.8 OneID - OneID

Founded in 2019, OneID is a UK-based 'identity fintech' vendor (OneID is a trading name of Digital Identity Net U.K. Ltd.). Its product OneID is a bank-enabled digital identity, facilitating onboarding and authentication using verified bank processes and profiles. It is specifically focused on serving the UK, leveraging the already high usage of online banking, accessible to 40 million individuals, to provide verified identities in other consumer IAM use cases.

OneID uses the identity information held by UK banks to verify and authenticate users to relying party services. The OneID platform works with identity providers (IdPs), being banks located in the UK. These provide verified account information along with KYC/AML functions, strong customer authentication (SCA), biometric authentication, fraud monitoring and other security functions. The platform also connects relying parties that require verified identities during onboarding, authentication, or uplift during high-value transactions. This network of relying parties includes DocuSign, Shopify, WooCommerce, and those in the finance, entertainment, retail, e-signing, and sports sectors. Attributes can be additionally verified with UK government services, credit agencies, and other attribute providers.

A typical onboarding flow begins with a user visiting a relying party app or site, and selecting "Register with OneID". The user is then prompted to select their bank and to consent to sharing particular data attributes with the relying party. Upon consent, the user is routed to their bank login page where they securely authenticate. After successful authentication and confirming details in a bank screen, the user is sent back to the relying party site with the requested information. Registration or order forms are automatically populated with verified data sent from the bank site.

OneID is certified to the UK DCMS trust scheme framework as an Identity Service Provider and Orchestration Service Provider. OneID leverages open banking certificates and financial-grade APIs (FAPI) to secure exchange between OneID and the IdP bank. Metadata, including provenance on verification measures behind each attribute can be shared as well (using OpenID Connect Identity Assurance), signed by the IdP bank to ensure validity.

It is a cloud-native platform with multi-tenancy. While the robust verification and fraud reduction capabilities are provided by the IdP banks, OneID enables enterprises to leverage the verified identities for consumer onboarding and authentication. With capacity to expand regionally and into electronic signature use cases, OneID is a compelling option for those looking to leverage online banking for verified identity.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

5.9 Onfido - Real Identity Platform

Founded in 2012, Onfido is based in London, UK. It provides fully automated as well as hybrid identity verification solutions, supported by its proprietary AI for document verification, biometric matching, and fraud signal detection. The Real Identity Platform serves primarily CIAM use cases ranging from onboarding and enrollment, deterring fraud, authentication, and step-up verification. Onfido provides wide geographical coverage for document verification and serves customers globally.

Onfido's Real Identity Platform provides automated identity verification at multiple points along a user journey: during onboarding, authentication, or during high-value transactions. The platform contains the Verification Suite made up of document verification, biometric verification, data verification, and fraud verification. This suite of verifications is flexible and can be configured to meet local requirements using Onfido Studio with no-code workflows, enabling businesses to customize which verification signals they deploy and when. Onfido's proprietary Atlas AI enables automation of identity verification and powers the risk and decisioning engine. The platform contains a no-code UI, analytics and dashboarding, and API support.

During an onboarding process, a user is prompted to scan an identity document with their mobile device. The document is first classified to determine the type and country it is from, then data is extracted both for verification against authoritative registries and for form auto-filling before data fraud and visual fraud analysis is performed. NFC verification supplements if the identity document has an embedded chip. Biometric verification is done by the user taking a selfie or asynchronous video, which is then analyzed for spoofing attacks, liveness detection, facial matching with the identity document and checking against a database of known fraudsters. Onfido's suite of data verifications check user data against authoritative sources such as the global sanctions watchlists, identity record databases, and SSN and the American Association of Motor Vehicle Administrators (AAMVA) for US users. Fraud detection is applied, including checking signals for device integrity, IP address, and geolocation signals. The results of the document, biometric, attribute, and fraud signals are fed to the risk engine which returns a verification result to the customer within approximately 10 seconds. The identity verification solution helps customers align with NIST IAL2.

The verified biometric information collected at onboarding can be reused for authentication. Use cases such as high-value transactions or account recovery are particularly suitable since the biometric template is linked to the verified identity. To use, the user takes a face scan, which is matched against the biometric template they provided during onboarding.

Onfido is a cloud service, exposed with REST APIs for backend integrations. SDKs are available for web, tablet, and mobile, both iOS and Android. Enterprises can determine whether their data is processed and immediately deleted, or stored by Onfido in AWS for future ML training. Onfido has worked with the UK's ICO to establish governance practices and compliant handling of training data.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.10 Ping Identity - PingOne Verify and DaVinci

Ping Identity was founded in 2002 and based in Denver, Colorado. It specializes in solutions for IAM and CIAM, and its products PingOne Verify and DaVinci orchestration engine allow the organization to conduct identity verification with a variety of document, biometric, and digital attribute evidence. Ping serves clients globally and is a main player in the identity market.

PingOne Verify is Ping's own verification service that covers document verification, biometric verification, aggregation from additional sources such as credit reporting agencies and telecommunications, and checks against international watchlists. These various proofing signals are collected and assessed to achieve the customer's desired level of assurance based on NIST 800-63-3, ISO 29003, and/or eIDAS standards and transform it into a digital credential. With the acquisition of ShoCard in 2020, PingOne Verify can integrate decentralized identity solutions into their technology stack that support W3C, DIF, decentralized ledgers such as Hyperledger Indy, and standards like the ISO 18013-5 mobile driving license. Depending on the customer requirements, the credentials can be used as workforce credentials or for CIAM use cases.

PingOne Verify conducts automated ID inspections by scanning the front and back of a government-issued ID with the user's mobile device, selfie-to-ID photo matching, and liveness detection. Documents that are supported include U.S. and international driver's licenses, ISO-based international passports, and European ID cards. An optional manual inspection of ID documents can support when and if automated decisions cannot be made. A decisioning engine, supported by manual inspection when necessary, determines the authenticity of identity documents and attributes and issues a proofing receipt. The proofing receipt and issued credential are bound to the device, and the related PII data is stored encrypted in the mobile device. While the identity is being verified, the data passes through Ping servers, to third-party services, and returns to the mobile device. The user PII data is then deleted from all Ping as well as third-party servers, except where the issuer is using Ping's optional directory services for verified attribute storage. For example, in banking transactions, the issuing banks typically maintain the data while the user still controls the private key. The identity data remains with the user stored on their device until they choose to share it.

The identity proofing flow can be integrated into onboarding processes or later in the lifecycle as needed by the customer. Identity is verified and credentials are issued via a web browser or native mobile SDK (available for iOS or Android) or via compatibility for third party wallets. Further functionality is enabled with the DaVinci orchestration platform, which provides over 100 third party connectors to additional document verification, biometric matching, and fraud reduction vendors.

PingOne Verify is a SaaS service, integrated into Ping's identity platform backend and other services like PingFederate to verify the identity of new registrants or during authentication. The product can however be deployed on premises, as a SaaS service, or as a managed service. The administrative dashboard and webhook data delivery service provides insights into transactions, fraud indicators, reasons for rejected transactions, etc. Account and password recovery are possible. Verified identity attributes are stored salted and hashed on the user's device or in a personal cloud, along with the associated private keys, and all PII data that was passed to PingOne Verify or 3rd parties is deleted. A blockchain-agnostic sidechain to Hyperledger (private permissioned) or Hedera, Ethereum, GoChain, Stellar, or BTC (public)is used to facilitate credential issuance and validation, with plans to move to additional public blockchains.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.11 Signicat - Digital Identity Platform

Signicat is headquartered in Norway and has been delivering identity solutions since 2006. It enables the customer to verify user identities by orchestrating verification steps across many regional partners, packaging identity information and delivering it to the customer. Signicat's Digital Identity Platform offers a suite of Sign-up, Sign in, and Sign it products, leveraging the verified identities of primarily European eIDs for onboarding, authentication, electronic signatures, seals, and time stamps. Recent acquisitions of Electronic IDentification, Dokobit, and Sphonic expand remote identification capabilities, orchestration and fraud reduction, and increases their technology partner ecosystem. Signicat has a primarily European focus, but is expanding their global coverage.

Signicat provides an identity hub for reading electronic IDs, electronic identity verification, and verified attributes. Signicat has over 30 integrations with primarily European eID providers, ranging from country schemas such as Nem ID and itsme to open banking ecosystem solutions such as Verimi and Yes. Signicat's Assure API normalizes attributes from the varying identity providers. To cover identity documents beyond these connectors, remote identity verification is provided in-house by subsidiary ElectronicID or by partners such as ReadID, Onfido, Facetec and WebID. These use methods such as document scanning, biometric onboarding, liveness detection, and synchronous video verification with a live agent. To support attribute verification and registry lookups, Signicat connects with over 25 regional attribute providers. Customers are able to choose which in-house and third-party services are used to achieve the level of assurance required by their use cases. NIST Identity Assurance Level 2 and eIDAS high can be achieved with the solution.

To conduct onboarding with compliant KYC/CDD checks, the identity is first proofed - ether using the eID connectors or with a remote identity verification flow – with attributes verified through authoritative records checks. The customer's target assurance level for onboarding and authentication can be customized and determines the strength of verification. Additional checks for politically exposed persons (PEPs), ultimate beneficial owners (UBOs), and sanctions lists support the KYC/CDD checks, with information on varying cross-border definitions provided to customers. The user can authenticate using a variety of authenticators, including eID or by using Signicat's MobileID, compliant with PSD2/SCA.

The solution can be offered using all major cloud platforms, Signicat does not hold any customer data, but it is stored based on customer requirements. Signicat's standardized APIs can be web-based or built into a customer application.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

5.12 Thales - Digital Identity and Security

Thales Digital Identity and Security (DIS) division, formerly called Gemalto, is based in Paris, France, and supports governments with their digital ID schemes with a wide portfolio of mobile and wallet ID solutions for citizens to provide a digital online identity. Thales provides mobile citizen identity solutions and eGovernment services, and identity/document/biometric verification and authentication for financial services and other industries globally. Thales can meet both IAM and CIAM identity verification use cases.

Thales provides verified identities with support for different mobile wallet formats that enable both online and in-person interactions: based on ISO 18013-5 for mobile drivers' licenses and mobile documents, based on the W3C standard for Verifiable Credentials, and for a mix of the two. The wallet can manage multiple digitalized credentials such as identity cards, mobile drivers licenses, digital travel credentials, and m-healthcare credentials with the ability to selectively share only information and attributes which are strictly necessary for the transaction, such as a proof of age, entitlements, etc. Different identification onboarding scenarios are offered to issue an identity credential with support from partners and in-house technology. Depending on the ecosystem in place, a user's identity can be verified remotely, based on non-electronic documents data capture and face recognition with liveness checks, through NFC reading of electronic documents, and facial recognition/biometric onboarding with a match on server process. The identity data is stored locally on the user's device. The identity verification can be conducted with mobile flows or with a web browser. The user is bound to their device during onboarding.

Once an identity has been verified and a credential issued to the user's wallet, in-person verification is possible by establishing a secure connection between two mobile devices (the digital ID wallet and the ID Verifier app) via QR code, NFC, and data transferred via Bluetooth, WIFI, or NFC. The identity credential is verified either with PKI or by providing a short-life token that checks the government source registry. Thales can provide both the user identity wallet and the verifier app. Offline verification of identity credentials is also supported. Authentication via biometrics, the Thales Digital ID Wallet app, PKI eID cards, and others is possible to customer and government web service portals.

In the backend, a modular digital identity services management platform pilots the digital ID and can provides self-service portals so users can manage their own identity, credentials, identity attributes, and consents. Identity data is encrypted with end-to-end protocols on the user's device. Additional multi-layered security is provided with RASP, obfuscation, device binding, and WBC. Interactions with other identification app holders is facilitated through a secure communication protocol, with data shared only after consent is provided and with users in control of the data they share. Data can be shared via Bluetooth, Wi-Fi-aware, or NFC and is compliant with ISO 18013-5 standard to offer interoperability. Thales Digital ID services platform can support various digital credential formats, including those based on the mobile doc ISO 18013-5 standard as well as the W3C Verifiable Credential standard to address decentralized identity models.

| Ratings | Security |  |

| Functionality |  |

|

| Deployment |  |

|

| Interoperability |  |

|

| Usability |  |

| Strengths |

|

| Challenges |

|

| Leader in |  |  |  |  |

5.13 TrustBuilder - TrustBuilder.io Suite

TrustBuilder is based in Gent, Belgium and was founded in 2017 with development beginning in 2016. It provides a full-service identity solution consisting of onboarding, verification, authentication, and authorization. Analytic insights and crafting of the user journey are also available. It joins identity providers (IdPs), service providers, and security providers together with an orchestrator and service catalog, provides MFA, and provides monitoring capabilities.